Skilling is a fintech company that offers services to clients in multiple countries. They operate from their offices in Limassol, Cyprus, the headquarters, and Malta and Spain. They have employees from different nationalities that work to meet their client needs. The broker offers multiple markets where you can trade, from forex, shares, indices, commodities to cryptocurrencies.

Pros

- Over 800 forex and CFD financial instruments.

- Allows mobile trading.

- High leverage of up to 1:200.

- Lower trading commissions are charged against the individual market.

- No deposit fees.

- Multiple trading instruments.

- There is negative balance protection offered.

Cons

- Swap charges at the end of a trading day.

- Currency conversion fees on MT4 platform.

- Deposit and withdrawal fees on by the payment service.

The company was founded in 2016 and opened its first office in Malta. The aim when starting entailed making trading simple and accessible to everyone. Its expansion saw them open offices in other two countries, Spain and Cyprus. Currently, the liquidity provider has extended roots in Europe and Seychelles. Clients access a wide range of markets with meager spreads and competitive leverage.

The asset basket holds products such as:

- Forex

- Shares

- Indices

- Commodities

- Crypto

These asset classes yield over 800 tradable instruments speculated by the broker’s global clientele with fast executions and meager spreads through its account types. Clients also face trading commissions betting on the prices of these products.

The array of accounts includes:

- Standard

- Premium

- MT4

Skilling accounts have similar features integrated, including total assets to trade, negative balance protection, and leverage. Standard is ideal for beginners, offering zero commission depending on the platform with spreads from 0.7 pips. In Premium account, spreads are from 0.1 pips while charging a commission on volume. MT4 is mainly recognized for forex. Clients fund and withdrawal money from their respective accounts through:

- Bank wire transfers

- Online wallets

- Credit cards

The broker has several helpful data sources that assist traders to effectively trade and be able to make informed decisions as well. They can be able to monitor market trends as well as use copy trading to see possible gain realization.

Regulation

The broker is regulated by recognized institutions. The regulators in place include:

- License No SD042 issued by Financial Services Authority (FSA) from Seychelles.

- License No 357/18 issued by Cyprus Securities and Exchange Commission (CySEC) from Cyprus.

- Reference No (FRN) 810951 AUTHORISED BY Financial Conduct Authority in UK.

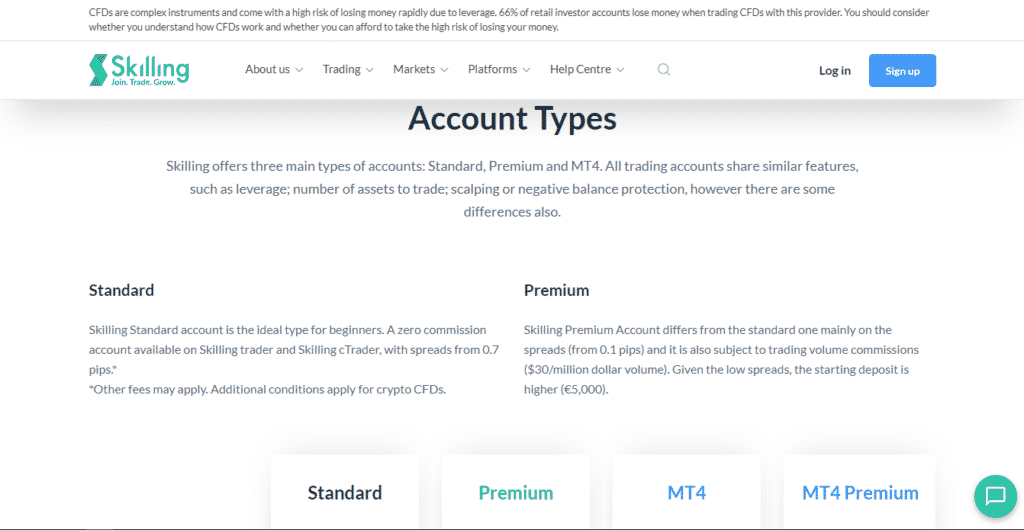

Account Types

It has varied accounts available for traders. The accounts are available to individuals being the retail and business entities offering to trade as cooperate accounts. The accounts each have a similar offering but defer to some extent.

Standard account

- Starting deposit of 100€

- Minimum balance — $0

- Spreads ranging from 0.7 pips

- Leverage retail at 1:30 while professional leverage at 1:200

- Lot trading 0.01

- No commission

- Ideal for beginners

- 73 currency pairs

- 10 cryptos

- Negative balance protection

- Swaps present

Premium account

- $30/million commission

- Spreads from o.1 pips

- Starting deposit €5,000

- Retail leverage 1:30 professional leverage 1:200

- 73 currency pairs

- Min lots — 0.01

MT4 account

- Minimum deposit €100

- Commission $30/million

- Spreads o.7 pips

- Retail leverage 1:30 professional leverage 1:200

- Trading lot 0.01

- 53 currency pairs

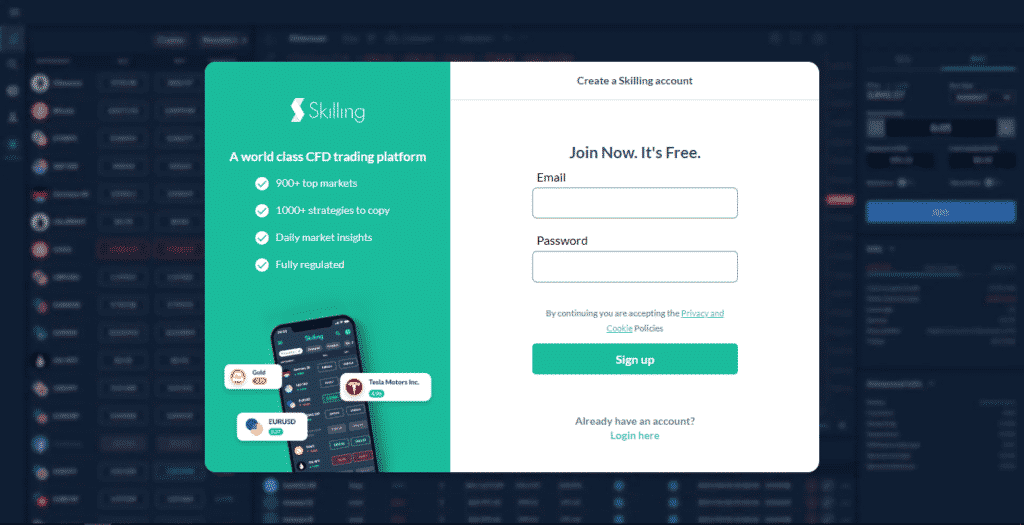

How to open a Skilling account?

It is easy to open an account while choosing either a live trading account or a demo account it is for clients to decide upon. A trading account allows one to register and trade after signing up with the following steps.

Step 1. Click on sign up after opening the website.

Step 2. Avail of necessary personal details and click sign up.

Step 3. Agree on the terms and submit the form.

Step 4. Verify your account details.

Step 5. log in to your account.

Step 6. deposit funds.

Step 7. Start trading.

Fees and Commissions

Skilling charges commissions on FX pairs and spot metals traded at $30/million USD. Swap charges are imposed automatically charged on a trading day done daily. Depending on the trading account, the swap charge may be negative or positive.

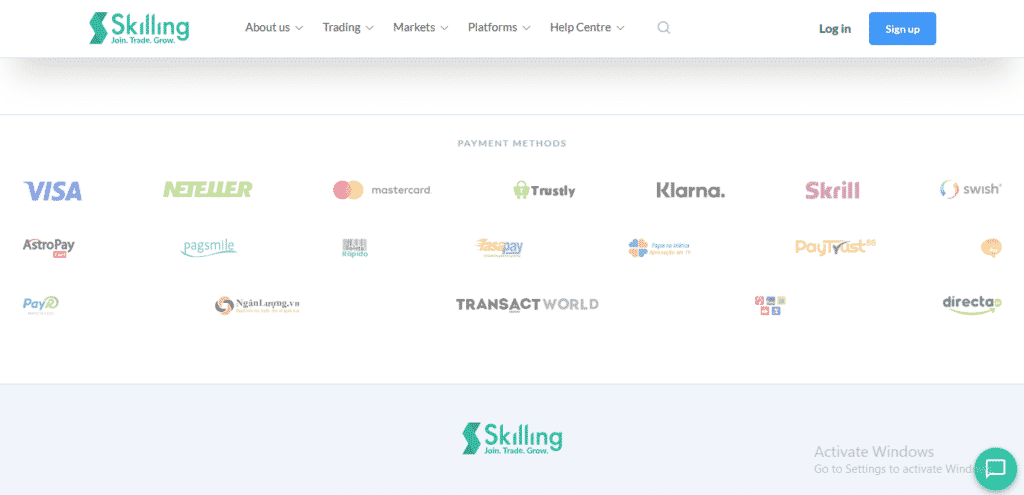

Payment options

There are various options for a client to choose from while making a payment. Whether online wallets, credit cards, or bank transfers, the client has options. The different platforms have incurring charges. The deposit amount is based against the set amount and is based on the set currency.

Pros

- Diverse payment platforms

- No fees on deposit

Cons

- There are charges imposed by payment platforms

Deposit

The broker offers the below methods of deposit:

- Bank Cards like Visa, Mastercard

- Online wallets such as Netteller, Skrill

- Bank wire transfers

Withdrawals

Similar to deposit methods.

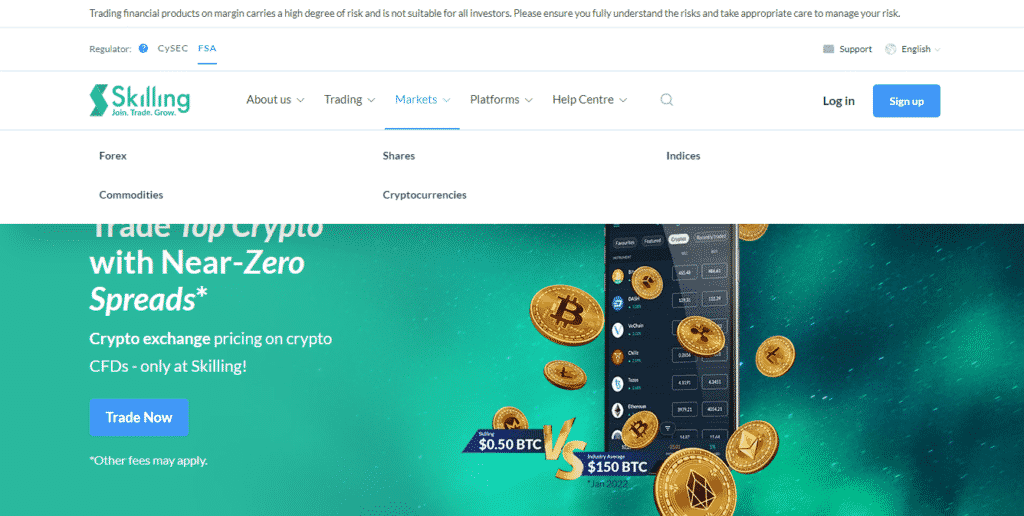

Available Markets

There are several markets offered across the Skilling platforms. They each have their basic requirements, such as commission and fees, and minimum deposits. The markets traded can either be retail, meaning for an individual, or offer a cooperate account for an entity trading. The markets include FX, shares, indices, commodities, and cryptocurrencies.

Forex

There are multiple currency pairs available for trading, with their numbers being over 70. Some of the available currencies are available for trade, and a competitive market spread is available. Using some of the platforms that allow access to currency trade will aid in gaining returns.

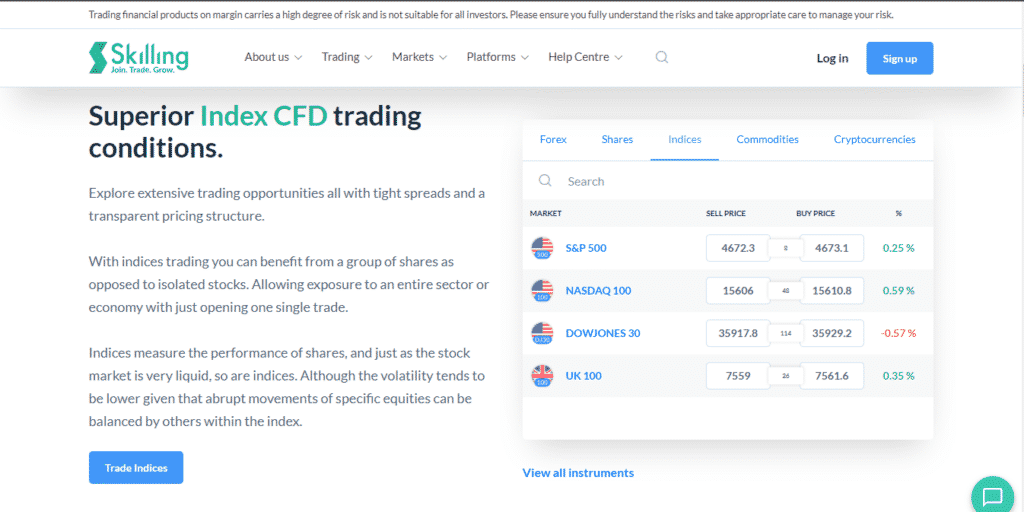

Indices

Indices investment can be good as it neither goes bankrupt nor dissolves, assuring long-term confidence for the trader, but low gains might not be evaded, though on the other hand. In indices trading, clients can benefit from a group of shares, which is different from separated stocks on the platform. There is a tight spread and a transparent pricing structure available on Skilling.

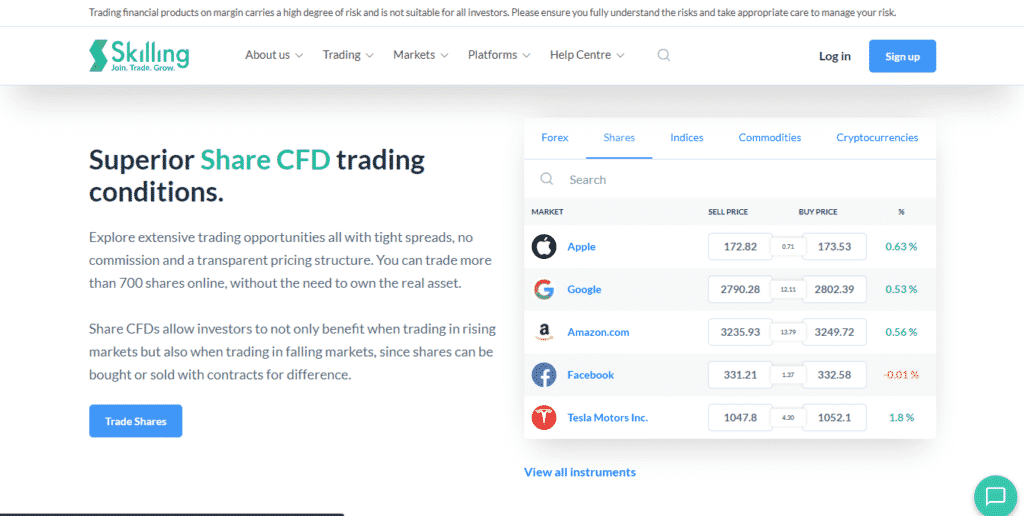

Shares

The broker offers more than 700 shares on their platform worldwide. Trading shares incurs no commission, and a given pricing structure is provided.

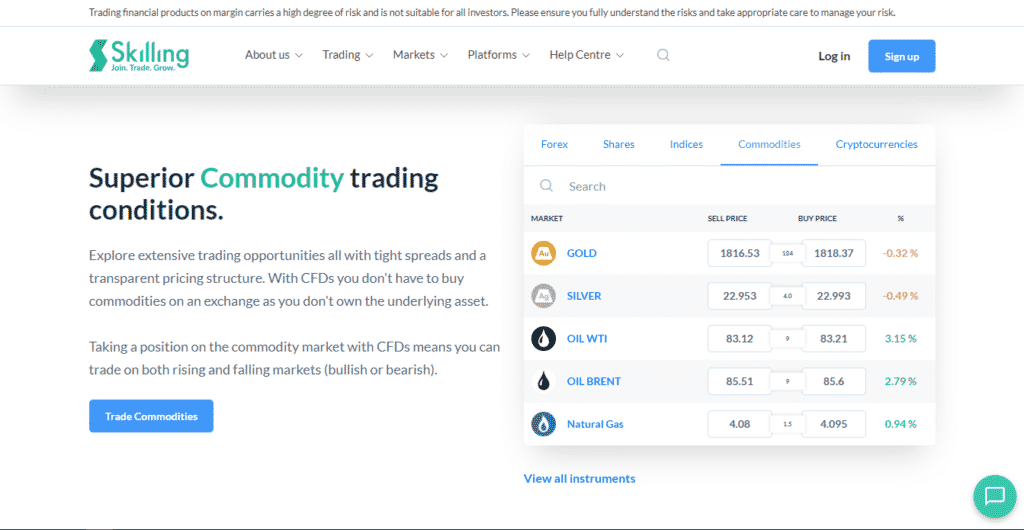

Commodities

One can trade some known commodities on the platform, including gold, silver, and oil. Traders are allowed to trade with spreads starting from 0.5 on the premium account, while on the standard account, the spread allowed is 1.3. A client is also allowed to trade on the price through futures which allows one to either sell or buy at an assured price.

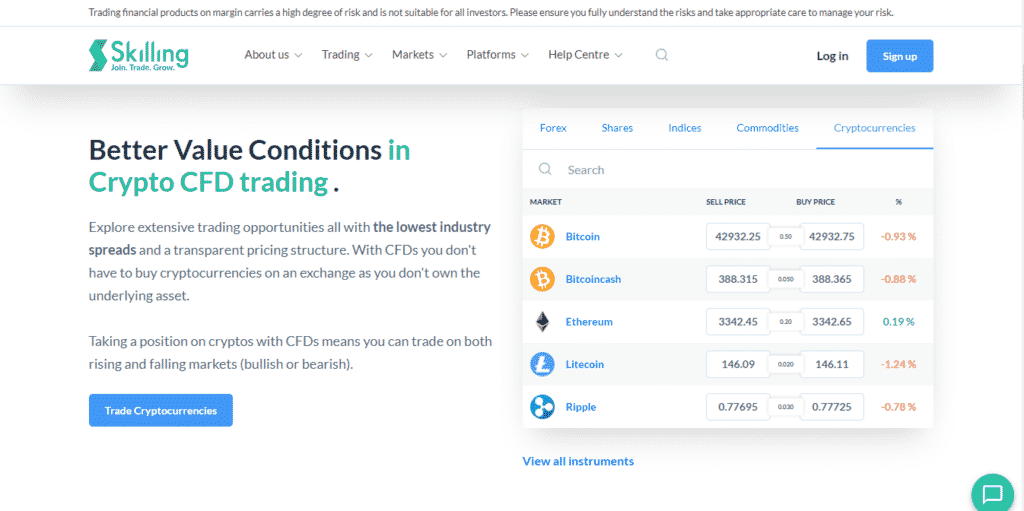

Cryptocurrencies

The broker offers some known cryptocurrencies to trade, including Bitcoin, Ethereum, Iota, and Litecoin. They are part of the top 34 cryptocurrencies available on the platform. Spreads present for trading start from 0.0001 to with long or short positions open to doing so.

Trading Platforms

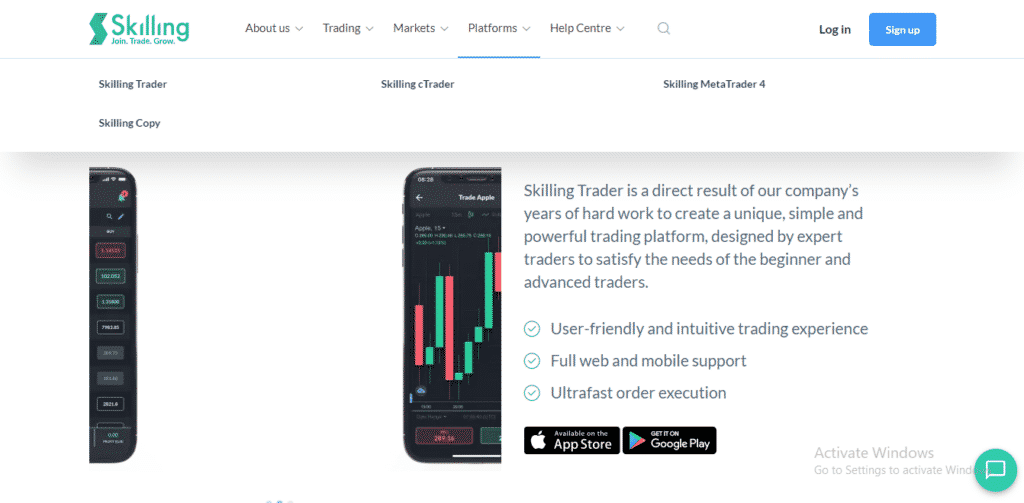

Skilling Trader

- Web and mobile support available

- Faster order execution

- User-friendly and intuitive trading experience

- Technical indicators and drawing tools

Skilling cTrader

- No commission

- One – account two platform trade feature

- Advanced trading platform

- Complete charting package

- Algorithmic trading

Skilling MetaTrader 4

- Automated trading with EAs

- Variety of technical indicators

- Established trading platform

- Desktop and mobile support

- 200+ trading instruments

Skilling copy

- Over 1000 strategies

- Equity stop-loss

- Easy access

- Equity to equity model

- Advanced trading platform

Features

There are several features:

Trading tools

- Expert advisors

- Copy-trading

- Hedging

- Trading articles

Analytical tools

- Market watch information tools

- Technical analysis tools.

- Indicators

- Algorithmic trading

Education

Those beginning and continuing trading on the Skilling platform can get relevant and vital information necessary for trading. Several trading articles are available on various markets and changing market landscape, and valuable data is needed.

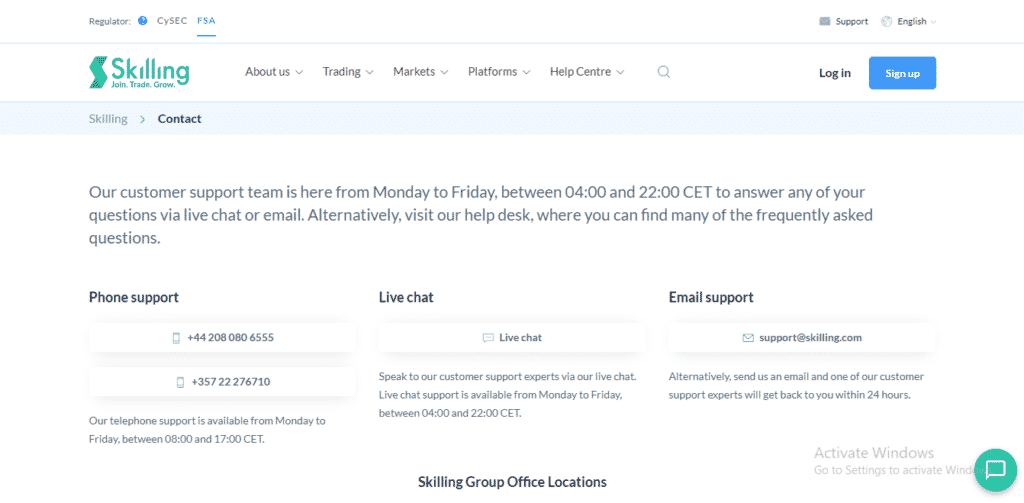

Customer Support

There are multiple customer support platforms ranging from telephone to live chat, allowing on-time messaging and email. Thus the customer can be assured to get timely feedback depending on the urgency of the concern. Apart from these, relevant data is available to aid in possibly solving similar worries with videos.

Review Summary

This brokerage company made its debut in the financial industry in 2016. They have several platforms from which a trader can choose and access from anywhere. They are regulated and licensed, ensuring safety for client investments.

They have built offices in several countries such as Spain, Cyprus, and Malta. They offer low commissions on various markets while at the same time charging swap costs, and their minimum deposit is relatively high compared with other brokers.