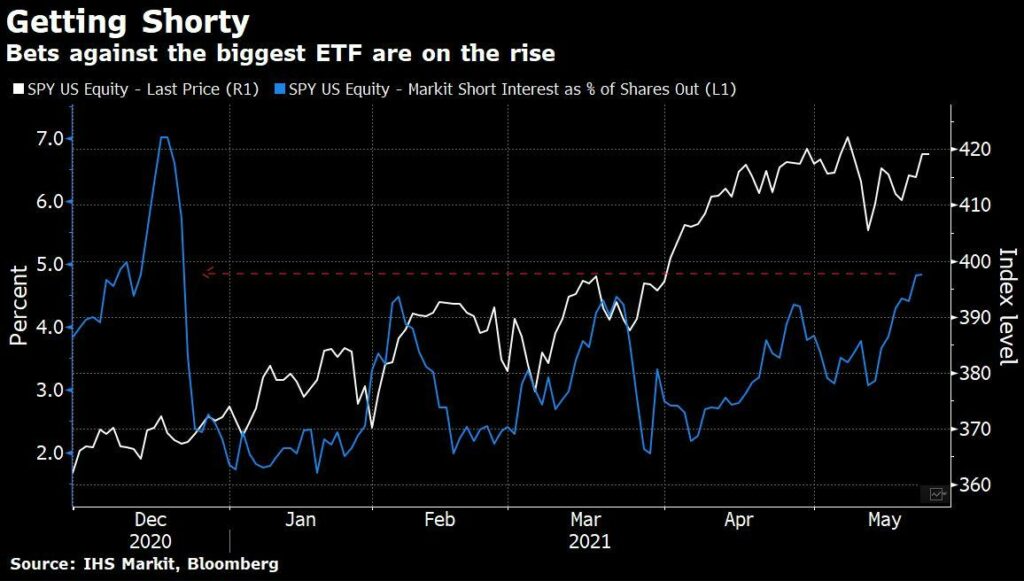

About 4.8% of the $357 billion SPDR S&P 500 ETF shares are out on loan, the highest this year, according to Bloomberg. The figure is above 2% recorded in about two months and a jump from 1.7% at the beginning of the year.

Despite failing to reach the highs hit in in the last two years, the S&P 500 ETF climbed beyond 7% more than once last year.

The bets against S&P 500 ETF reflect caution that its recent rally can proceed or a pullback is imminent.

Independent Advisor Alliance’s Chris Zaccarelli doesn’t expect the bullish run to end soon but expects a pullback of about 10% based on previous trends.

The mixed reactions on S&P 500 ETF comes when investors are rotating to stocks linked to economic cycles amid rising inflation and expectations of an uptick in interest rates.

Citigroup analysts predict bearish markets to kick in for the next 12 months based on current levels.

Susquehanna International strategist sees negative real earnings and dividend yield in S&P 500 that could hurt returns in the near term but expects temporary pullbacks.

SPDR S&P 500 ETF is currently gaining. SPY is up 0.36% on premarket.