R Factor EA is a Forex robot that is based on 4 years of development and three years of positive results in the live market. It is priced at $509, but the vendor also offers a free demo version of the software that you can use to carry out the tests. The vendor claims that this system can help you win profits even if the market conditions are difficult.

Now, similar claims are made by other Forex EAs on the market, and we can’t just trust a system based on the claims of the developer. A thorough and unbiased analysis thus needs to be conducted in order to gauge the robot’s profitability.

R Factor EA Trading Strategy

R Factor EA uses a dynamic portfolio algorithm that is based on the Kelly Criterion management. In this scheme, the focus is on the pairs that are performing well, so the losing pairs have a minimal impact on your profits. Due to this, the winning pairs grow independently in your portfolio, enhancing the probable gains for the present and the future.

While this leads to a volatile portfolio, the profit that is attained makes the risks worth taking. While this is a decent explanation of portfolio balancing, the vendor has not provided any technical details about the strategy that is used for extracting profits. It would be great to know what indicators R Factor EA uses, and how it identifies profitable trades.

Using R Factor EA, you can trade in 12 different pairs. For a single pair, you can start with a capital of $30, while the full portfolio requires an initial balance of $100. Risky strategies like Martingale and Averaging are not used by this system.

R Factor Features

R Factor EA has definite take profit and stop losses for every trade and in trades only in one pair at a pair. In order to ensure you never suffer from lost trades, it uses an intelligent trade exit system. It is based on advanced backtest simulation with high spread periods. There is an exclusive R Factor EA group for customers where you can access the latest sets, strategies, and developments.

R Factor EA Backtesting Results

The vendor has shared some screenshots of backtesting data, but they are not independently verified by a third-party source. In the absence of verified backtesting data, it is difficult to assess the system’s profitability. The results could have been easily manipulated by the vendor in the absence of a third-party verifier, so we cannot consider them as legitimate ones.

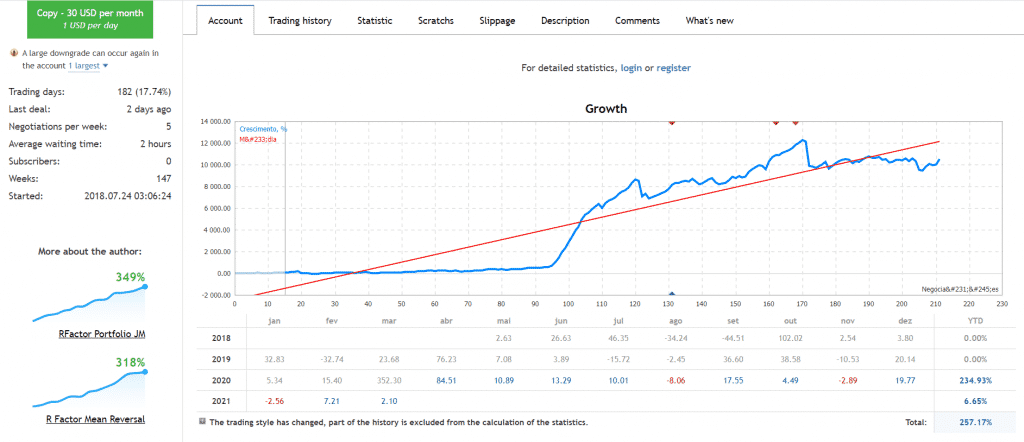

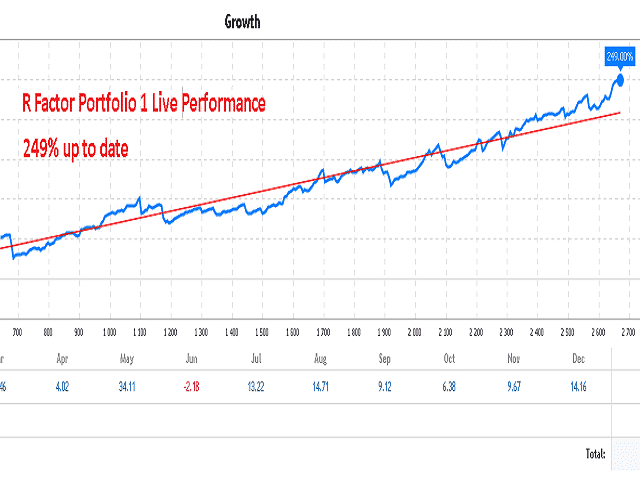

R Factor EA Live Trading Results

Live trading results have been shared by the vendor on the MQL5 page. Although this account shows a growth of 249%, we cannot rely on it since it is not verified by trusted sources like Myfxbook and FXBlue. Seasoned Forex traders always look for verified live trading results, since they reflect the true performance of the system, free from all kinds of manipulations.

Since R Factor EA does not have verified live trading results, we cannot say with confidence that the system is capable of extracting profits. Considering the tall claims made by the vendor, we were hoping to find some evidence of the system’s reliability, but unfortunately, there are none.

R Factor EA Reputation

The creator of R Factor EA is a Brazilian trader by the name of Raphael Minato, who has been trading in options, futures, and stocks for 16 years. He has almost 7 years of experience in the Forex market and has published live signals showing positive performance for more than 3 years. There is no record of him developing other systems in the past, and we have no way of verifying his identity and location.

There are no user reviews for R Factor EA on FPA, Quora or Trustpilot. Since the Forex robot was launched earlier this year, it could be that it doesn’t have much of a reputation as of now. It is quite evident that not many people are using the system currently since it doesn’t furnish live trading results and is relatively unknown.

R Factor EA Review Summary

- Strategy – 5/10

- Functionality and Features – 5/10

- Trading Results – 4/10

- Reliability – 4/10

- Pricing – 3/10

Conclusion

After carefully assessing all the system components, we have reached the conclusion that R Factor EA cannot be trusted. First of all, it is an expensive Forex robot that has no verified proof of profitable live trading results, and secondly, the vendor doesn’t reveal what trading strategy is used by the system.

Although backtesting data is available, it is from an unverified source. There is a lack of vendor transparency as well, and we are not sure whether the developer is capable of creating a profitable system. Finally, the lack of user reviews tells us that this is not a reputable system, and it is highly likely to be a scam service.