With the promise of automating profits, Ninja Scalper expert advisor offers an enticing array of features for amateur and experienced traders. Statistical analysis is the basis for the strategy used by this Forex robot.

The product is available in four different packages ranging from the basic package that costs $30 for 30 days up to a full lifetime Wow package that costs $149. Is this scalping-based Forex robot a viable choice for you? Read this Ninja Scalper review to find out.

Ninja Scalper Trading Strategy

This expert advisor is created to work best on the EURUSD currency pair and uses the 5-minute timeframe. It applies statistical analysis over 20 years to decide the right entries and exits. Trend indicators, including the MACD indicator, help decide the trades.

According to the website info, traders can start with a minimum of $30, which can be used in a cent account. We are disappointed that the vendor does not offer any additional data regarding the specific strategy used.

Furthermore, info on the developer is also not available on the site. These two factors indicate transparency issues that make us suspect the reliability of this system.

Ninja Scalper Features

With a very low minimum balance required for the trading account, this Forex robot has features such as dedicated support through WhatsApp/email for proper installation of the system. And, with the risk management feature, users can set the maximum limit for the drawdown so only controlled risks are taken.

Besides these features, there is also the facility to choose lot size automatically or manually. Just as many of its competitor Forex robots, this system also provides access to its Telegram group, which has over 140 members.

Ninja Scalper Backtesting Results

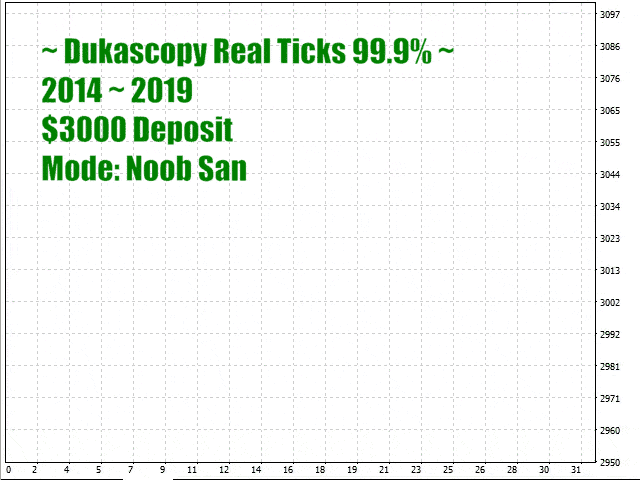

Historical data from the Metatrader 4 platform and a real tick simulating platform are used by this system for its backtesting. With 99.9% accuracy, the vendor claims the results are reliable and consistent. A screenshot of one of the tests is shown below:

The above strategy test done over 6 years shows appreciable returns for a deposit amount of $1000. While the backtesting results may look profitable, they are to be taken with a bit of salt as they cannot accurately predict the future performance of the system.

Ninja Scalper Live Trading Results

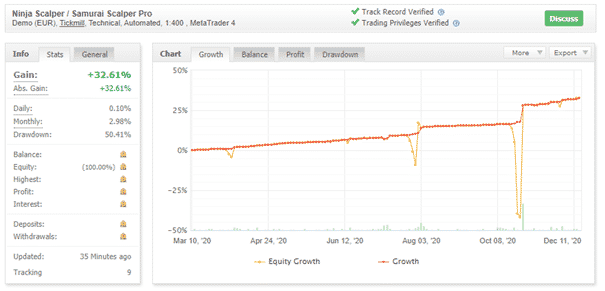

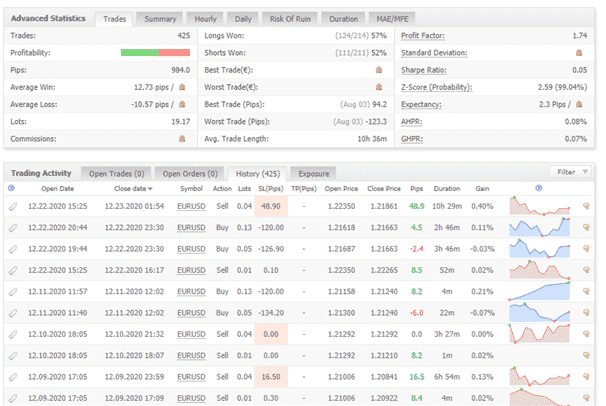

A single verified demo account with Tickmill broker and leverage of 1:400 is displayed on the official site. From the screenshot shown below, the gain and absolute gain indicate 32.61% while the daily gain stands at 0.10% and monthly returns at 2.98%.

However, what we are worried about is the drawdown that is set at 50.41%. Any percentage that is over 20% indicates a high-risk strategy that is not preferred by most traders. A 50% or more drawdown denotes that the system had lost about half of its balance at a time.

This is typical with scalping trades and we would have liked to see more details on the performance but were unable to do so because many of them were hidden. From the lot sizes, it is clear that the risks taken are huge, which can put the deposit of the trader at risk at any time.

Ninja Scalper Reputation

Since the website does not offer data on the creator of this Forex robot, we were unable to find info about the reputation of the vendor. A location address is provided at the bottom part of the home page, which indicates the system has its headquarters in Brazil. Other than this info, the complete lack of data on the developers is a shortcoming that we would like the vendor to rectify in the future.

User feedback is a wonderful tool to assess a Forex robot’s performance and the support it offers. Unfortunately, there are no credible user feedbacks on trusted sites like Forexpeacearmy, Trustpilot, etc.

Ninja Scalper Review Summary

- Strategy – 4/10

- Functionality & Features – 4/10

- Trading Results – 3.5/10

- Reliability – 3/10

- Pricing – 4/10

Conclusion

Summing up our Ninja Scalper review, this automated Forex trading system has a lot to improve on several fronts. To start with, the basic data on the trading approach is not explained clearly nor is information provided regarding the creators behind this system.

While backtesting results and trading results are given these only serve to confirm our suspicions of the system not performing up to expectations. And, the verified results are just for the demo account. We would like results for a real account which will further add to the details gained from the existing account.

Another significant downside is the absence of feedback from users. User reviews are essential to understand the support offered and the performance of the expert advisor. Given the array of shortcomings this system presents, we do not recommend it.