Neuro FX Robot is such a new EA that was released at the beginning of November 2020. It was introduced to the Forex-related community as “everything that we need” to be profitable, trading on MT4.

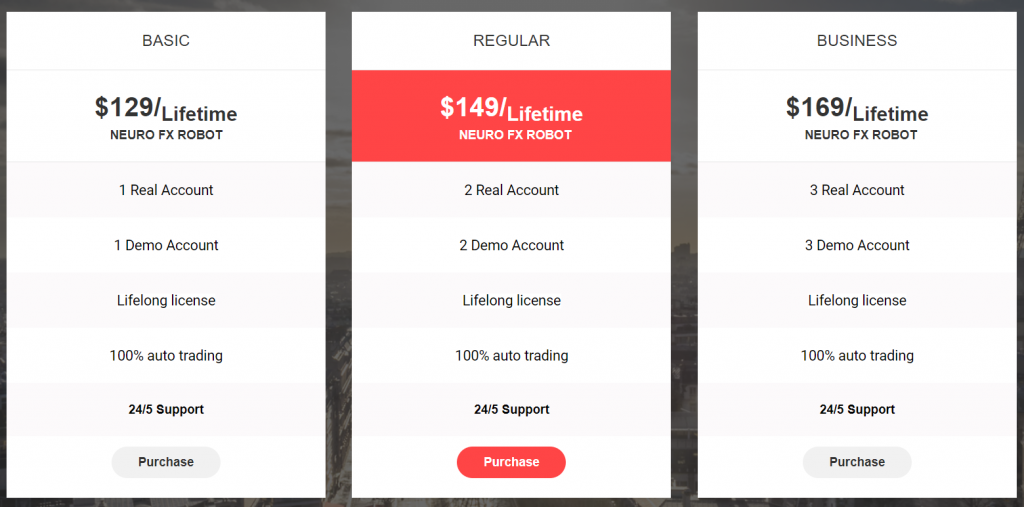

The EA has been introduced in three packages: Basic, Regular, and Business. The Basic pack costs $129 for one real and one demo account license. The Regular pack costs $149 and includes two real and two demo accounts. The Business pack costs $169 and is featured by three real and three demo licenses. All packs include support. We don’t know about free updates and refund policy.

Neuro FX Robot Trading Strategy

The robot has a well-designed algorithm with an unnamed strategy. The devs insisted that there’s no Martingale on the board. It trades GBP/USD on the H1 time frame.

Neuro FX Robot Features

The robot has many useful features that we’ve gathered in the list:

- Neuro FX Robot performs all trades automatically. There’s no need for our intervention.

- The robot doesn’t use high risky strategies.

- There are no high margin requirements.

- It’s a complete experience free solution.

- The robot has an inbuilt money-management.

- Risk management allows opening trades with automatically calculated Lot Sizes.

- We may not turn off the EA during high impact news.

- We can trade on an ECN (STP – Straight Through Processing) account.

- The robot supports various account sizes: Standard, Micro, and Mini.

- The EA doesn’t need any special or additional customizations.

- The minimum margin requirement for each 0.01 Lot is $100.

- The optimal will be $200 for each 0.01 Lot.

- The developers recommended us to use VPS.

Neuro FX Robot Backtesting Results

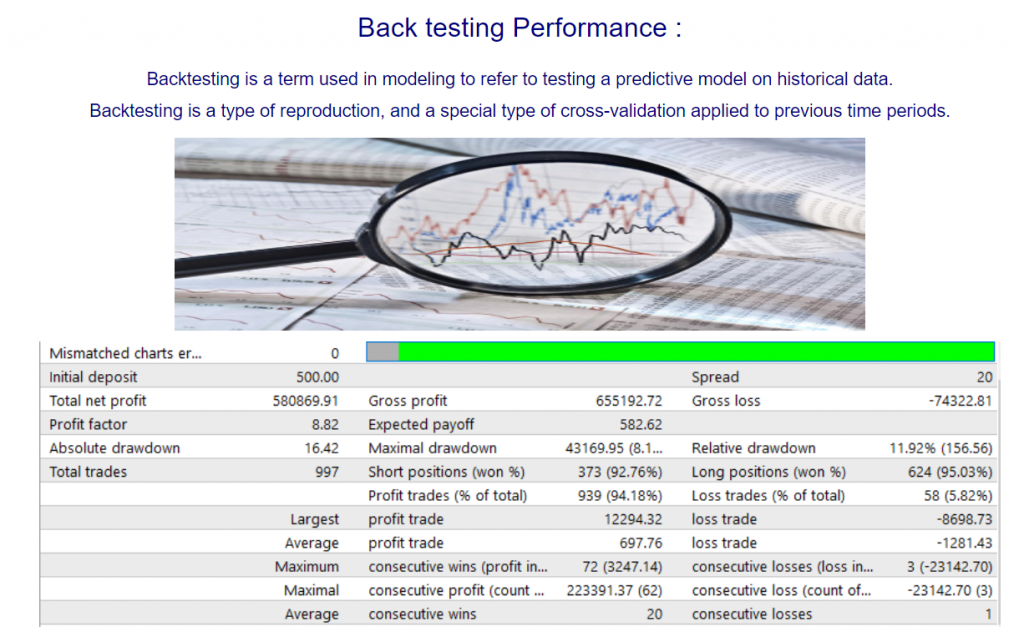

We have an onsite, not verified backtest report. An initial deposit was $500. The total net profit has become (for what period?) $580k. Modeling quality was unknown. The spreads were 20 pips. The Profit Factor was 8.82. A maximum drawdown was 8.1%. The robot performed 997 trades with a 92% win-rate for Shorts and 95% for Longs. We have ant proof that this report is a real one, not photoshopped.

Neuro FX Robot Live Trading Results

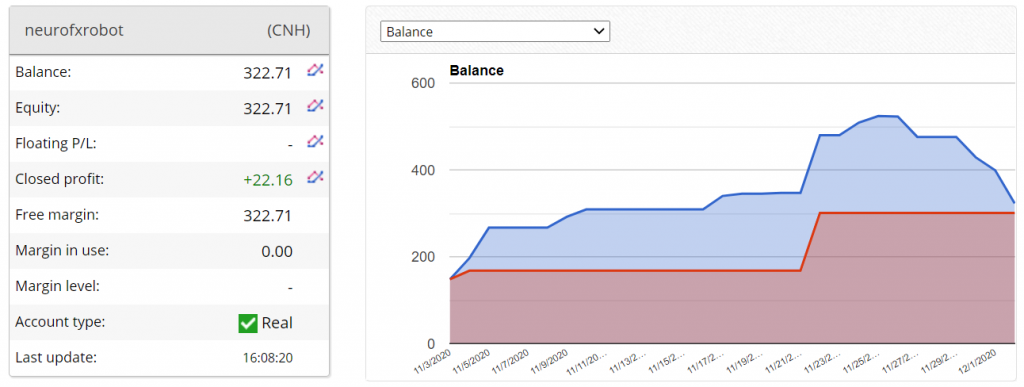

The developer shared a link on a real CNH (China Yuan). The account was created on November 3, 2020. It was deposited three times at 301 CNH in total. The chart shows us that there is something wrong with the EA.

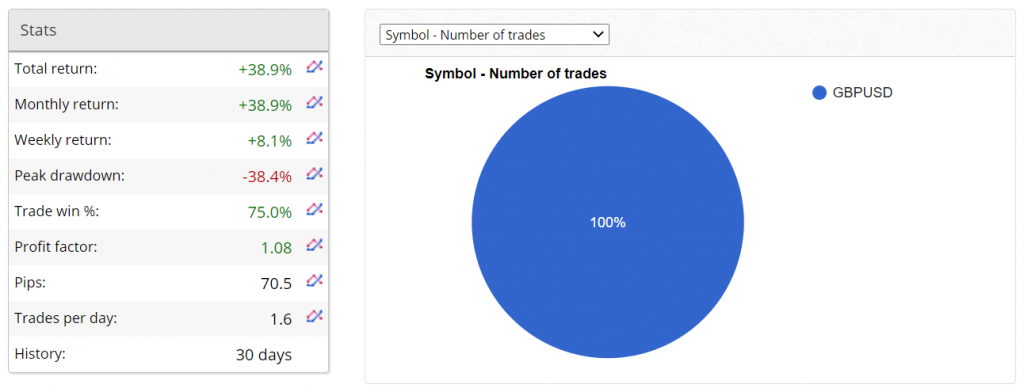

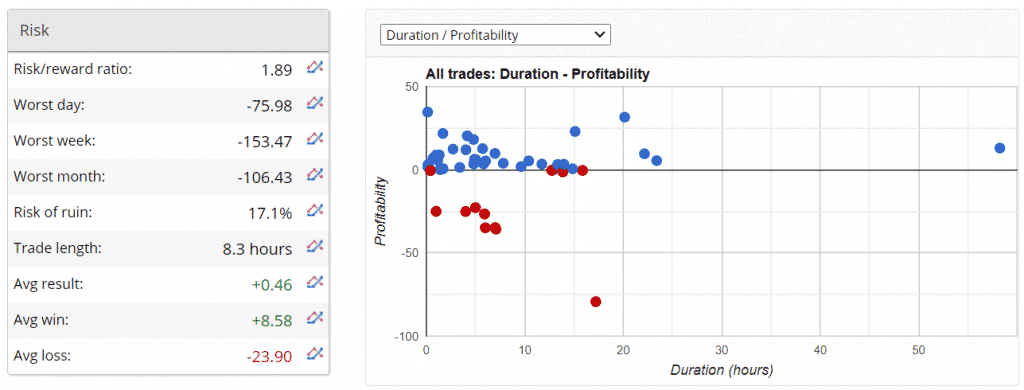

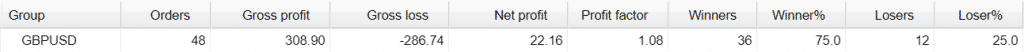

After the fall, for 30 days, the robot has provided +38.9% of the total return. The EA works only with GBP/USD, as was told. The weekly return is +8.1%. The maximum drawdown is so high (-38.4%). An average win-rate is 75%. The Profit Factor is incredibly low (1.08). An average trade frequency is over ten deals weekly.

The risk of ruin is the account is very high (17.1%). An average win +$8.58 is three times higher than an average loss -$23.90.

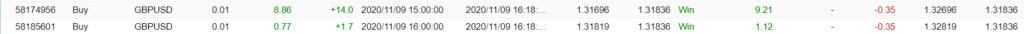

The robot works with GBP/USD.

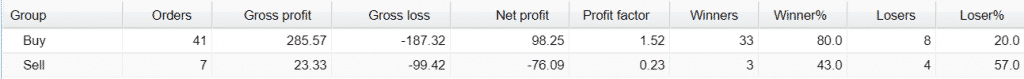

The BUY direction has over five times of closed deals (41) than SELL. Seven deals of the SELL direction have brought -$76.09 of profits (0.23 Profit Factor).

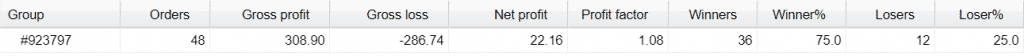

The system unites only one strategy (#923797).

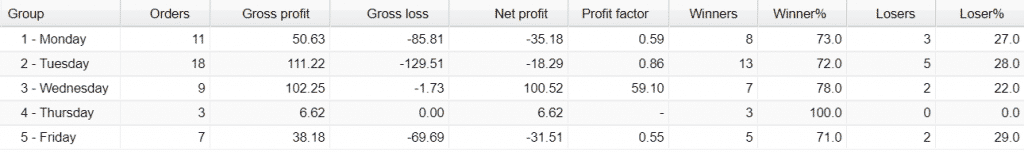

Most deals were opened on Monday and Tuesday. The most profitable day was Wednesday with +$100.52.

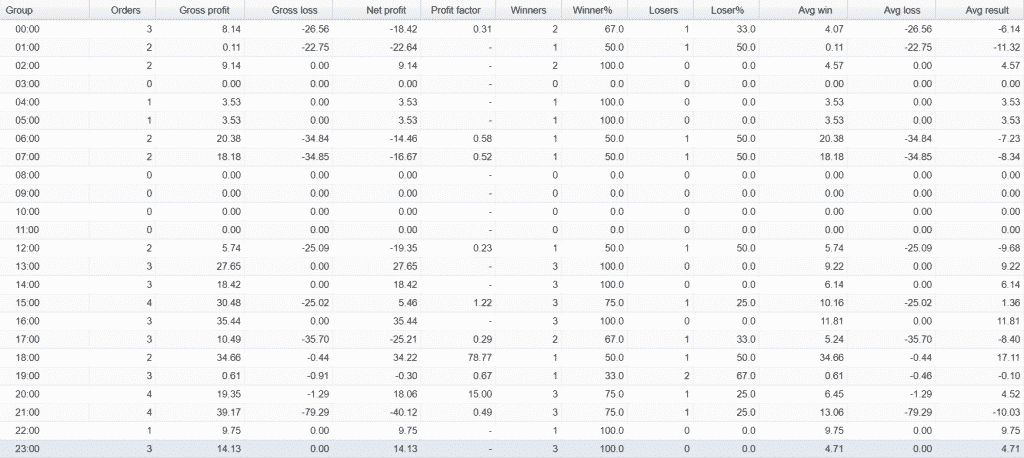

The robot focuses on trading the second half of the European session and American session from the opening to closing.

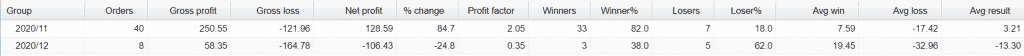

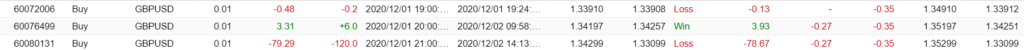

As we can see, several days of December 2020 have blown all November’s efforts.

Something went wrong with the EA. The last two weeks have brought -$3.44 and -$153.47 of losses.

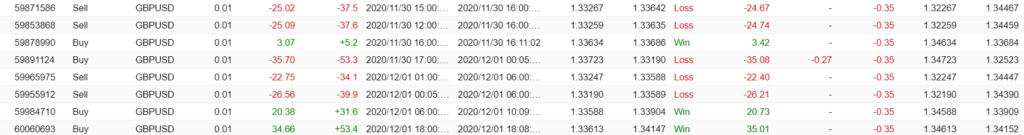

As we can see, the SL level is between 34 and 53 pips.

The last trade has shown that something was broken in money-management, and the deal reached a -120 pips level.

The EA uses Hedging in trading.

Neuro FX Robot Reputation

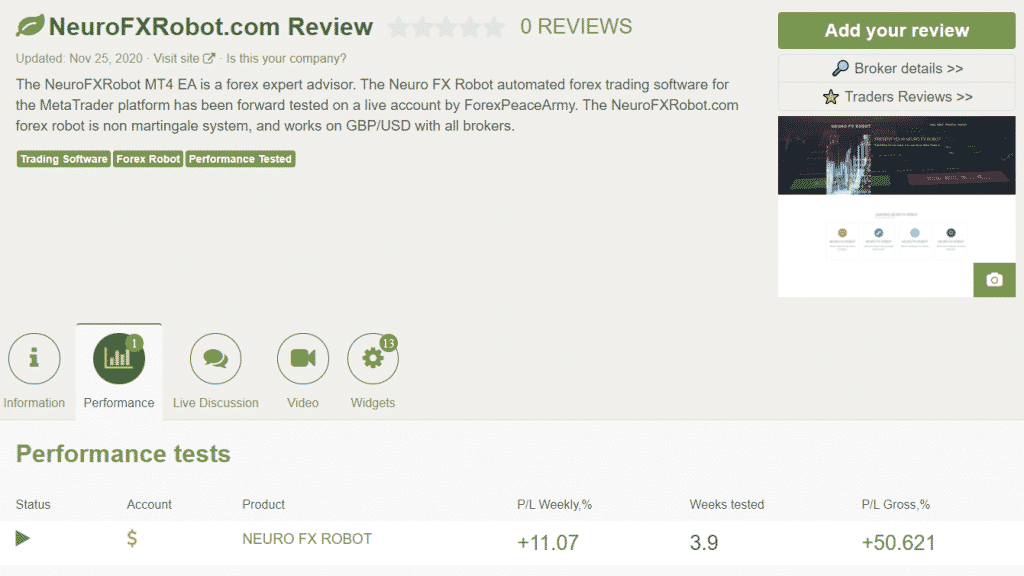

The company has a profile on Forex Peace Army with a connected account. People have left no reviews or testimonials.

The company uses a common email to communicate with clients.

Neuro FX Robot Review Summary

- Strategy – score (0/10)

- Functionality & Features – score (3/10)

- Trading Results – score (0/10)

- Reliability – score (1/10)

- Pricing – score (3/10)

Conclusion

Neuro FX Robot became scam software just several days ago. As we could see, it started losing many deals in a row, and SL levels were set high. We knew that the EA could lose only one deal in a row from the screenshot of the backtest. Live results show that’s a wrong statement.