We’d like to read a review of ICHI Scalper 2.0. This EA is powered by a Synergy FX company. It’s introduced as the software that’s been used by their client base for the last four years.

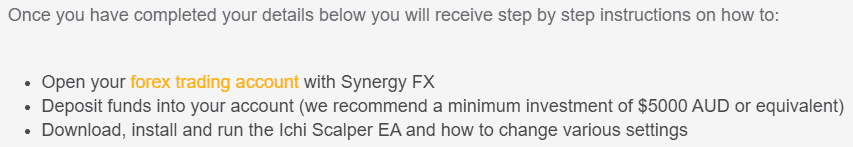

The robot has no price in common meaning. We have to register an account and deposit it at A$5000 to get the EA.

ICHI Scalper 2.0 Trading Strategy

It’s a sideway trend trading scalper that focuses on a single currency pair – AUD/USD. It scalps on the M5 time frame.

ICHI Scalper 2.0 Features

- The system works fully-automatically.

- It works with AUD/USD on the M5 time frame.

- It makes money trading sideways trends.

- There are five levels of risk, from conservative to the most aggressive ones.

- The EA can experience drawdowns up to 30% for several days of keeping deals on the market.

- We can run it on our PC. No VPS is needed.

- The minimum deposit requirements are 5000 AUD. It’s a scam to ask for that deposits for a little time frame scalper.

- The system trades with placing Stop Loss and Take Profit levels.

ICHI Scalper 2.0 Backtesting Results

The developers decided that people don’t need backtest reports, and they can trust them only because they’re a broker house. No, it’s not. It’s a big disadvantage in our eyes.

ICHI Scalper 2.0 Live Trading Results

There should be trading results, but we have to request this info. Alas, the requesting form was removed.

The same, we saw on another page. Do the devs want to rock us with a 2017 year report? It’s almost 2021.

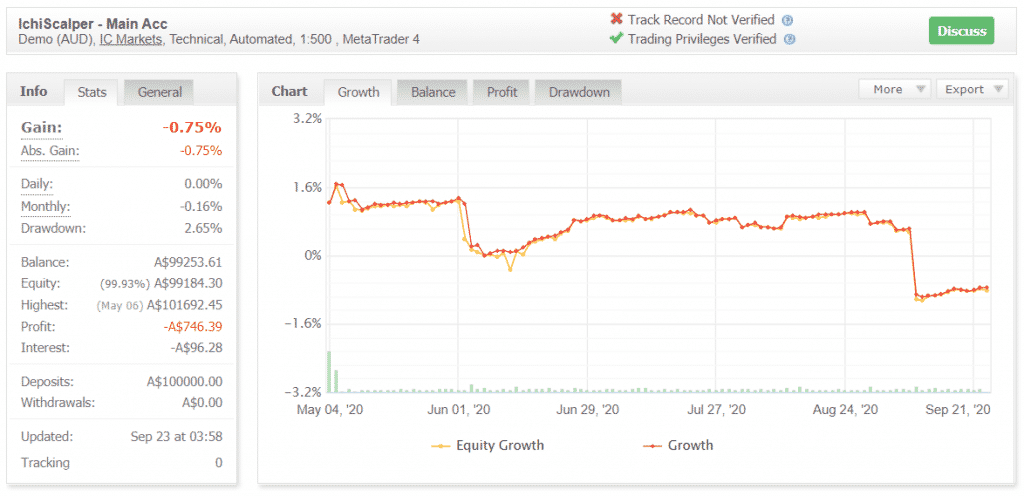

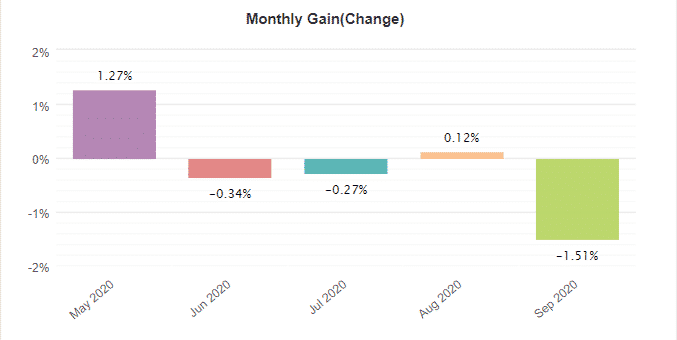

We’ve googled for trading results. The newest account was this one. It was a demo AUD account on IC Markets. The EA traded automatically, having used technical indicators. The leverage was 1:500. It worked on MT4. The account didn’t have a verified track record. It was created on May 04, 2020, and deposited at A$100k. The absolute gain has become -0.75%. An average monthly gain was -0.16%. The maximum drawdown was a little one – 2.65%.

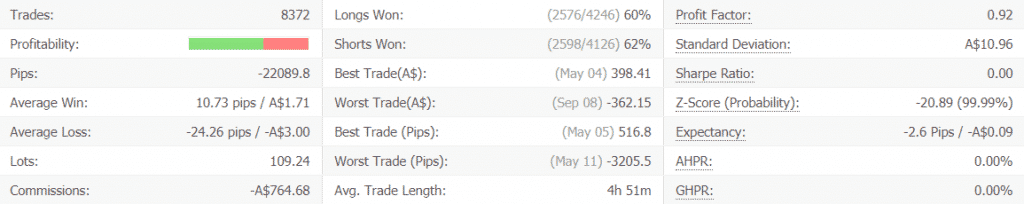

It closed 8372 deals with -22089 pips. An average win (10.73 pips) was twice fewer than an average loss (-24.26 pips). The win-rate was 60%-62%. The average trade length was almost five hours. The Profit Factor was less than 1 (0.92).

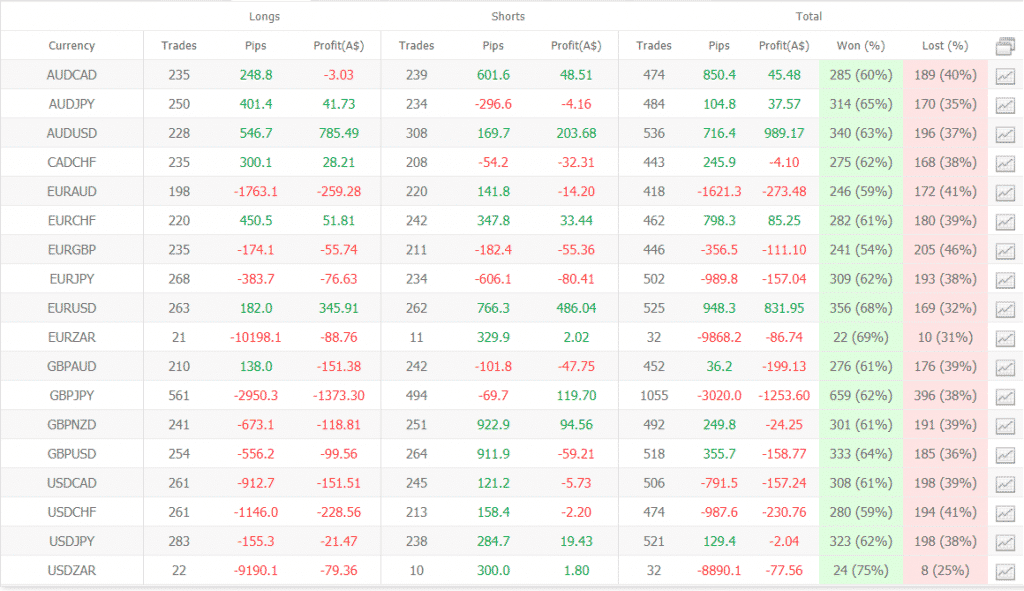

As we can see, it traded many symbols, but there were profitable only AUD/USD ($989) and EUR/USD ($831) currency pairs.

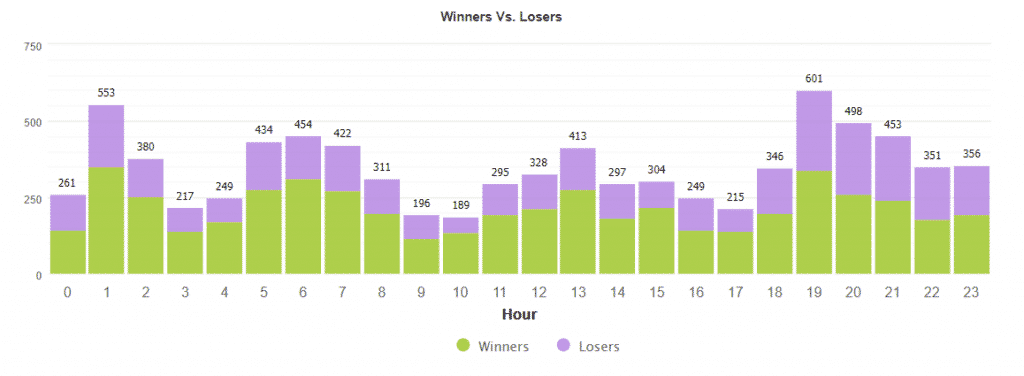

The EA focused on trading during American and Asian sessions.

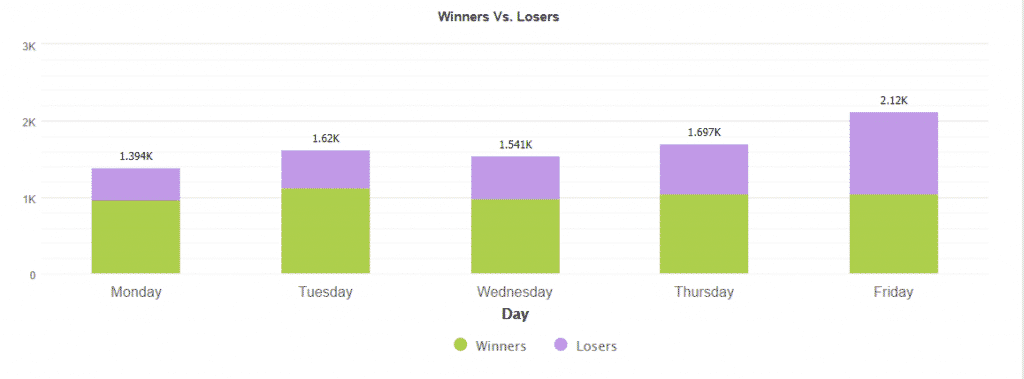

The most-traded day was Friday.

We still can see open trades.

The EA has never been a consistently profitable trading solution.

ICHI Scalper 2.0 Reputation

The EA has no reputation, but a company behind it has.

It received an award in 2015 as the Best Broker in Australia.

The presentation is featured by several comments that say how traders were happy to try this EA. There’s nothing special.

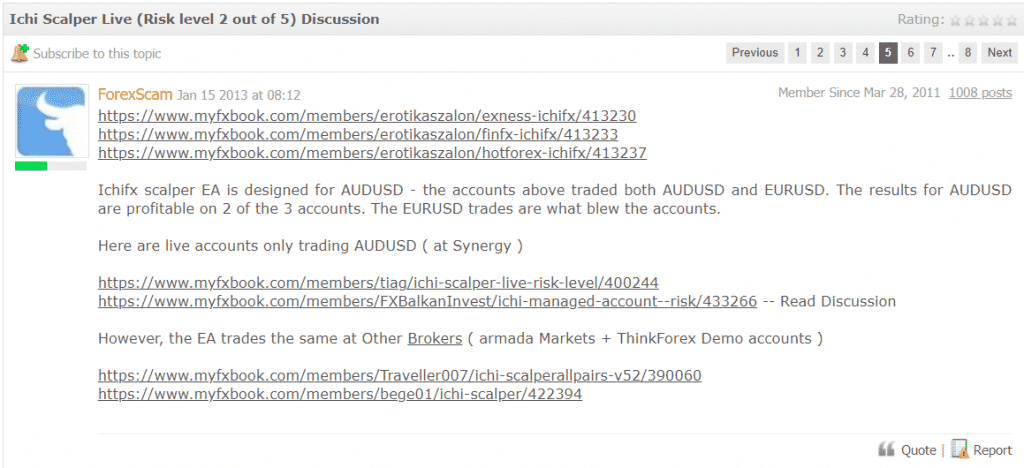

There are several topics to discuss details of the EA performance. We can see many blow accounts there since 2011.

ICHI Scalper 2.0 Review Summary

- Strategy – score (4/10)

- Functionality & Features – score (3/10)

- Trading Results – score (0/10)

- Reliability – score (2/10)

- Pricing – score (5/10)

Conclusion

ICHI Scalper 2.0 is a scam software that has a huge negative history of using it. The first version has brought many blown accounts since 2011. The second one is not much better. The developers didn’t provide any proof of its profitability. There are no backtest and trading results at all. Depositing a real account at A$5000 just to check that the EA is a scam is much money. The site looks abandoned. It seems to us that the developers don’t care about it at all.