It has emerged that a total of 30 companies listed on the Nigerian Exchange Limited (NGX) paid the Federal Inland Revenue Service (FIRS), and other revenue agencies a sum of N919.5billion as tax in first quarter of 2025.

This represents a significant increase of 276 per cent when compared to N244.71 billion paid in first quarter (Q1) of 2024.

The 30 firms cut across the banking sector, cement manufacturing companies, Fast Consumer Moving Goods (FCMG), power companies, Oil & gas, telecommunication, among other critical sectors of the nation’s economy.

Aside from paying the statutory 30 per cent income tax, companies operating in Nigeria are meant to pay Education tax, National Information Technology Development Agency (NITDA) tax and Nigeria Police Trust Fund levy.

The tertiary education tax is imposed on every Nigerian company at the rate of 2.5 per cent of the assessable profit for each year of assessment, while the Act that established the Nigeria Police Trust Fund was meant to receive funds from a levy of 0.005 per cent of the net profit of companies operating a business in Nigeria and other various sources, which will be utilized for the training and welfare of personnel of the Nigerian Police Force.

Extracts from the companies’ Q1 2025 unaudited results released by the NGX revealed that Seplat Energy paid the highest tax expenses, followed by Dangote Cement Plc.

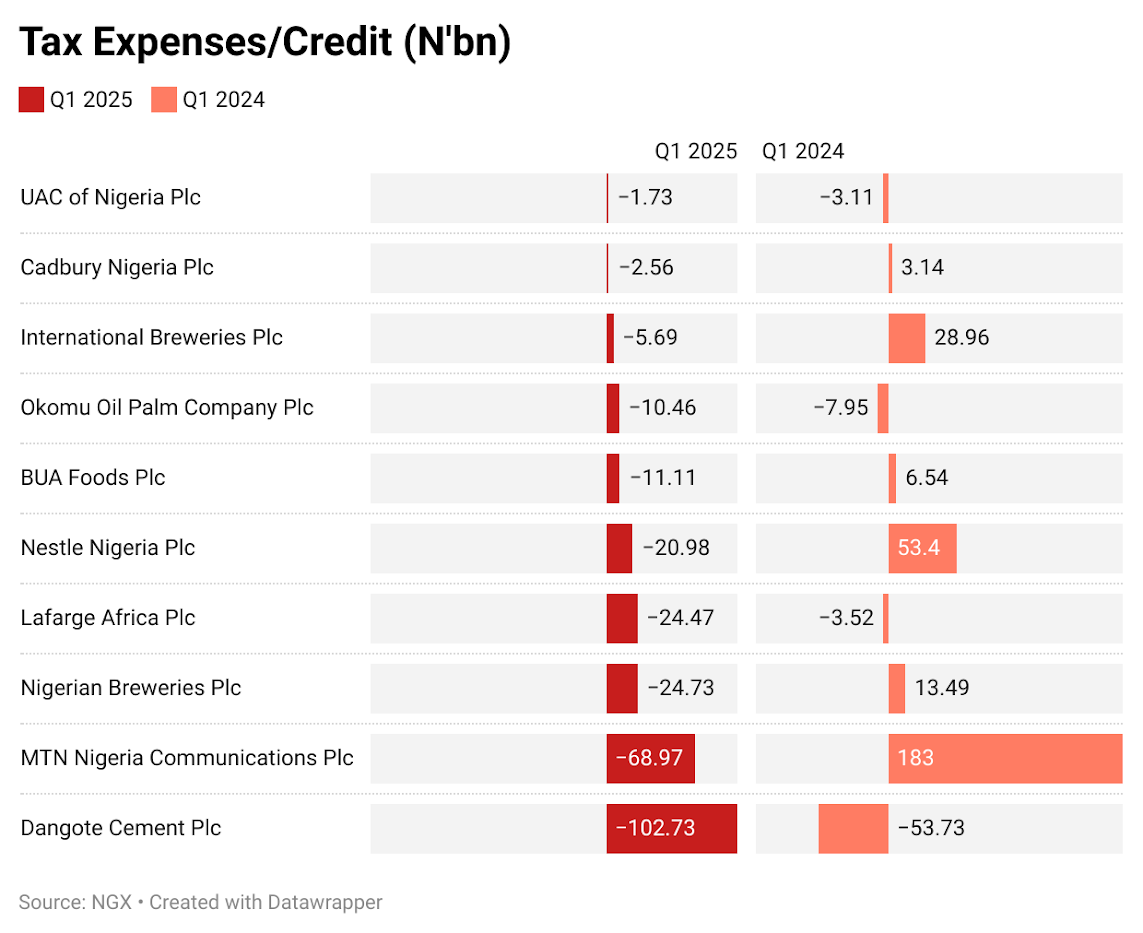

Seplat Energy reported N279.26 billion ($184.11million) tax expenses in Q1 2025, representing an increase of 162 per cent from N106 billion ($71.22million) reported in Q1 2024, while Dangote Cement announced N102.73 billion tax expenses in Q1 2025, up by 91.2 per cent from N53.73 billion in Q1 2024.

According to a Seplat statement, “The income tax expense of $184.1 million (Q1 2024: $71.2 million) includes a current tax charge of $215.0 million (Q1 2024: $13.9 million) and a deferred tax credit of $30.9 million (Q1 2024: $57.3 million charge).

“The higher tax charge in the income statement reflects the current tax due in SEPNU. For the offshore assets, we expect the current tax charge to moderate overtime as the pool of available capital allowances increases as we increase our investments across the asset base.”

For Dangote Cement, it declared N88.09 billion current tax in Q1 2025 from N28.81 billion reported in Q1 2024, while its deferred tax expense dropped to N14.6 billion in Q1 2025 from N24.9 billion in Q1 2024.

Both Seplat Energy and Dangote Cement declared a sum of N2.22 trillion revenue in Q1 2025, representing an increase of 105 per cent from N1.09 trillion declared in Q1 2024.

THISDAY learnt that Cadbury Nigeria Plc, Nestle Nigeria Plc, MTN Nigeria Communications Plc, Nigerian Breweries Plc and International Breweries Plc that had tax credit in Q1 2024 due to foreign exchange losses, paid tax to FIRS, among other agencies in Q1 2025.

For instance, MTN Nigeria Communication that declared N182.99 billion tax credit in Q1 2024 paid N68.98billion tax in Q1 2025, while Nestle Nigeria paid N20.98billion tax in Q1 2025 from tax credit of N53.4billion in Q1 2024.

Nigerian Breweries paid tax expense of N24.7billion in Q1 2025 from tax credit of 13.49billion in Q1 2024.

In addition, International breweries declared N5.69billion tax expenses in Q1 2025 from tax credit oof N28.96billion in Q1 2024, while Cadbury Nigeria posted N2.56billion tax expenses in Q1 2025 from N3.13billion tax credit declared in Q1 2024.

The five multinational companies recovered from 2023 & 2024 financial losses to declare N367.4 billion profit before tax in Q1 2025 when compared to N937.17 billion loss before tax declared in Q1 2024.

These five multinational companies experienced substantial foreign exchange losses in 2023 & 20024 financial year, primarily due to the naira following the Central Bank of Nigeria (CBN) exchange rate liberalisation in June 2023.

The policy by CBN led to a sharp depreciation of the Naira, adversely affecting MTN Nigeria, among others with foreign currency denominational obligations.

Capital market analysts noted the importance of companies remitting taxes to government agencies, stressing on the role played by listing on the Exchange that gives room for companies to be transparent in tax payment to government agencies where they operate.

The analysts added that the new government reforms may hike tax expenses on listed companies.

The Chief Operating Officer of InvestData Consulting Limited, Mr. Ambrose Omordion stated that listed companies over the years maintained stronger profit, which is meant to contribute to government tax revenue.

He expressed that most companies that were reluctant to come to the stock market were hiding their financials. He said: “Once the government can work together with the FIRS to enforce tax laws, there would be no hiding place for companies. Thus, they will be forced to get listed which is expected to drive transparency and more non-oil revenue to government.”

Speaking, the Vice-President, Highcap Securities Limited, Mr. David Adnori hinted that listed companies may be paying more taxes this year, stressing on its importance on shareholders’ return.

He expressed that failure to pay tax by listed companies might force the government to shut branches and truncate operations, stating that the tax system in Nigeria must be streamlined to enhance effective remittance in order not to create dispute between the company and the government.

He, however, added that tax remittance is meant to facilitate economic growth and companies must always oblige in promoting remittance, most especially to state governments where they have branches.

According to him, taxes paid by companies are based on laws and regulations, stressing that companies are meant to play by the rules, which has to do with full disclosure.

He explained further that, “A good number of income that companies generate are exempted from tax. Banks are not meant to pay tax income on treasury Bills, government bonds and agriculture loans. If you take all of those, sometimes you will find out that tax banks are paying effectively on their profit, maybe less compared to manufacturing companies, not that they are not deliberately not paying taxes.”

He stressed the need for banks to come together and make a total tax income contribution to the country’s gross domestic product (GDP).

President Bola Tinubu had approved the establishment of a Presidential Committee on Fiscal Policy and Tax Reforms and appointed Taiwo Oyedele as the chairman of the committee.

The government said the establishment of the committee reflects Tinubu’s commitment to addressing challenges and bringing about transformative reforms in fiscal policy and taxation.