GameStop’s stock traded within double-digit losses and gains in early New York trading after Robinhood markets restricted its trading, reports Bloomberg. GameStop, AMC Entertainment Holdings Inc., Express Inc., BlackBerry Ltd, and Koss Corp. option trading were among entities put into “liquidation only” due to extreme volatility in the markets.

- Wedbush Securities Inc. analyst Michael Pachter has criticized the current move against GameStop and other targeted entities, saying investors need to be allowed to trade whatever they wish.

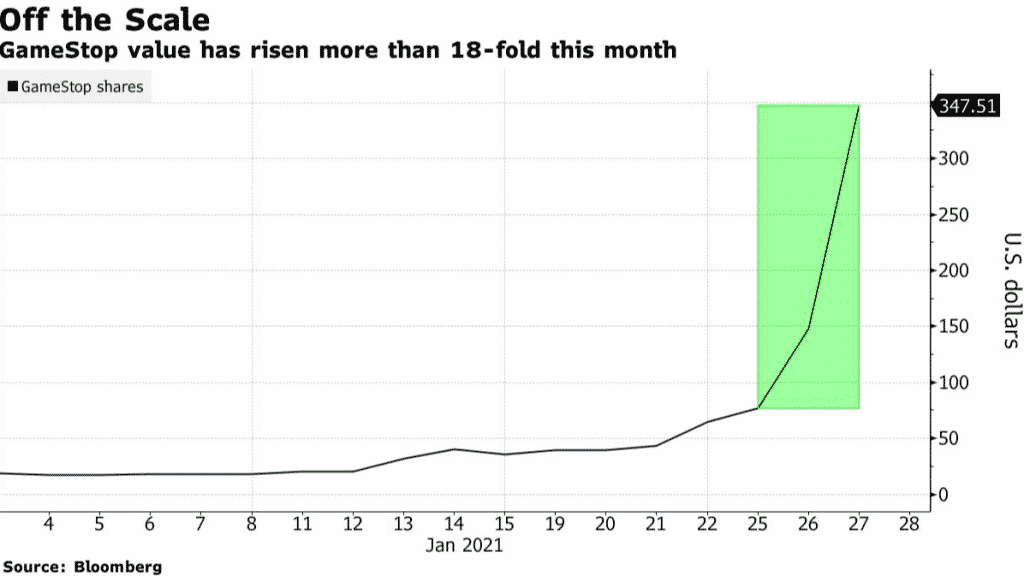

- GameStop has gained 1,700% this year, having surged more than 40% earlier, pushing the stock above $500 fueled by retail trading as short-sellers cut losses.

- GameStop’s gains pared postmarket after the Reddit page that fueled the month’s surge was made private and then reopened by the group’s moderators.

- Citigroup Inc. analysts have warned that some exchange-traded funds face an outsized influence from GameStop as its boom has altered their composition.

- Analysts Scott Chronert has warned that a larger allocation to GameStop stock may materially change fund performance until a rebalance occurs.

- GameStop’s rally has attracted regulatory scrutiny, with Senator Elizabeth Warren calling the Securities and Exchange Commission to act while economy watchdogs monitor heavily shorted stocks.

GameStop’s stock is currently gaining. GME: NYSE is up 6.75%