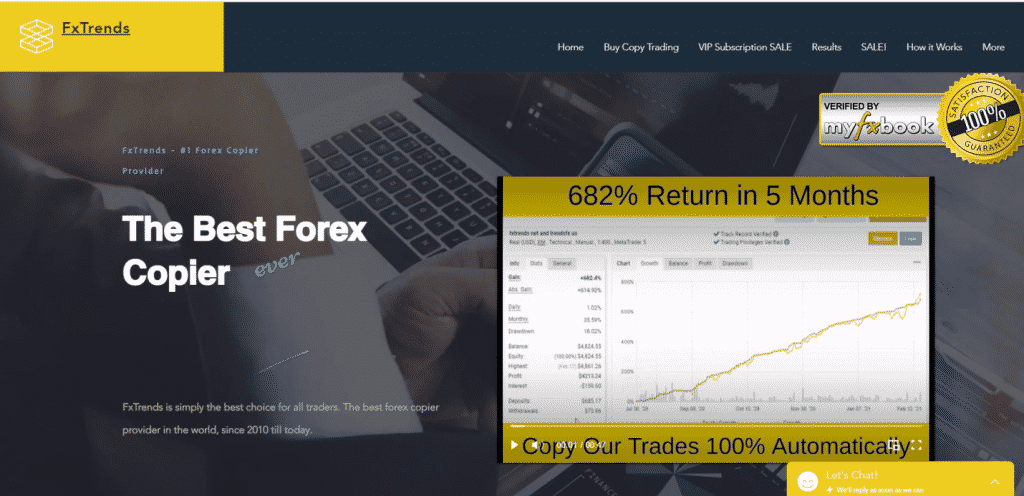

FXTrends is a Forex EA that promises more than 2000 monthly pips and high-quality trading performance for both new and expert traders. As per vendor claims, it is backed by verified live performance and numerous testimonials from real users. It is advertised as a system that would help you get out of losing trades and start earning profits again.

There are three distinct pricing plans offered by FXTrends for 1 month, 3 months, and 7 months durations, and these cost $29.99, $69.99, and $150, respectively. With the last two plans, you get VIP personalized support. Compared to the market average, the pricing plans are quite affordable.

FXTrends Trading Strategy

After subscribing to FXTrends, you need to download the signal receiver using the link sent to you via email. Next, an account will be opened in the Auto Trading software that will copy the trades into the MT4 account. In order to register with the signal receiver, you need to use the credentials you received via email. Finally, you can start receiving signals after choosing a trading terminal.

The vendor mentions that FXTrends uses strategies that bring consistent results while keeping the drawdown minimum. But nothing is mentioned about the technical aspects of the strategy, i.e. what indicators are used, how trend strength is gauged, etc. Many Forex traders study the trading strategy to gauge the system’s profitability, and they might take this as a red flag.

FXTrends Features

FXTrends is a Forex EA that has been developed with mathematical precision and is user-friendly. Customer support is available 24*7 in both English and Spanish. It is compatible with both MT4 and MT5 platforms and has numerous features using which you can customize the software as per your needs. Since it supports ECN, you can use FXTrends to trade in different types of financial instruments.

The automated signals provided by this system have the lowest possible latency. 8-19 trades are copied every day with an average winning rate of 90%. There is a learning channel where new traders can improve their craft and an advanced trading course for expert traders. It takes only 5 minutes to set up this fully-automated system.

FXTrends Backtesting Results

We couldn’t find any backtesting data for FXTrends on the official website or on Myfxbook. Many Forex traders look for backtesting data since it tells them whether the system can survive in periods of high market congestion, and how it responds to major news events. Backtesting results reveal the robustness of a Forex EA, and without it, we can’t really gauge its efficacy.

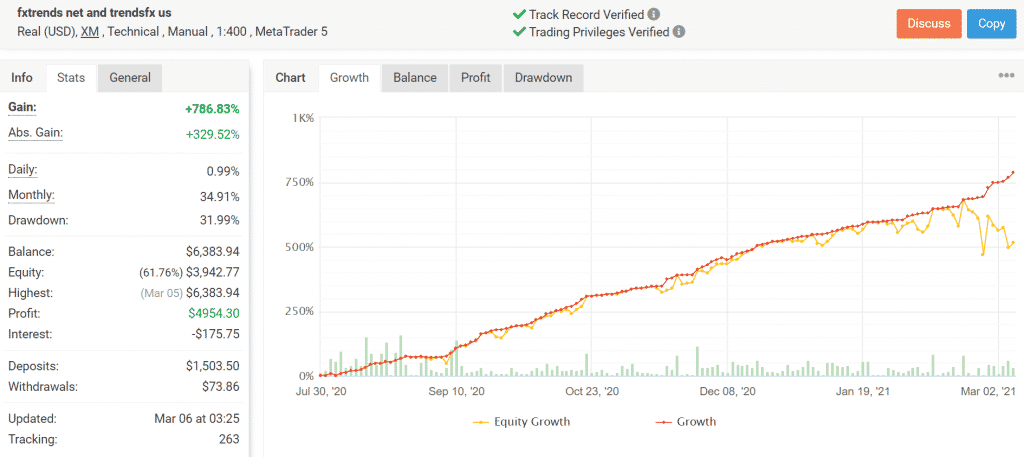

FXTrends Live Trading Results

FXTrends has provided us with live trading results on an account that’s independently verified by Myfxbook. It was opened on 30th July 2020, and to date, it has managed to accumulate a profit of $4954.30 from deposits of $1503.50. While the daily and monthly gains of 0.99% and 34.91% are more than decent, the high drawdown of 31.99% is a cause for concern.

A total of 831 trades have been placed through this account, and we can see any trades involving pairs like NZD/JPY, EUR/JPY, CHF/JPY, USD/JPY, etc. FXTrends has won 74% of long trades and 77% of short trades, with the combined win rate being 77%. The average win stands at 65.03 pips/$11.56 while the average loss is -94.21 pips/-$12.30.

Last but not the least, the profit factor for this account is 3.07. It’s quite remarkable for a Forex EA these days to have such a high profit factor, and it tells us that FXTrends manages to close most of its trades in profits.

FXTrends Reputation

There is little or no information on the official website about the company behind FXTreds. We don’t know who the developers are, where they are located, or if they have any prior experience in developing Forex robots. Vendor transparency is something all potential buyers consider before investing in a system like this, so the lack of the same might deter many traders from investing.

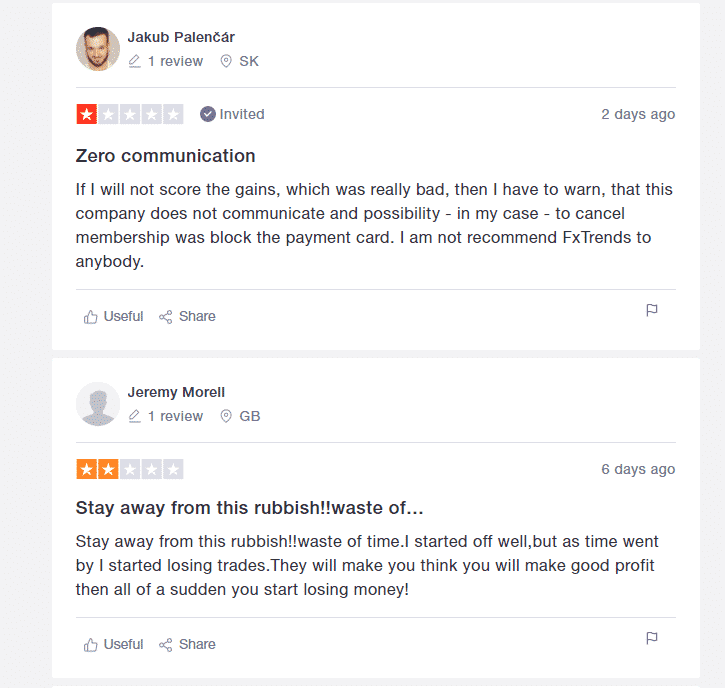

We found some reviews for FXTrends on the Trustpilot website, and they don’t look too flattering. One trader has complained about losing trades consistently with this Forex EA, while another has criticized the bad customer service, while also mentioning that the company blocked his payment card. It seems FXTrends uses a risky Martingale strategy that leads to huge losses, and thus many traders choose to stay away from it.

FXTrends Review Summary

- Strategy – 5/10

- Functionality & Features – 6/10

- Trading Results – 7/10

- Reliability – 5/10

- Pricing – 6/10

Conclusion

After assessing the different aspects of FXTrends, we have reached the conclusion that it cannot be trusted. First of all, the vendor doesn’t reveal any information about the company, and if the customer reviews are anything to go by, the customer support team is not the most helpful. Although the live trading results are decent, we cannot invest in a system based on that only.