Cosmonaut FX EA is an automated system that combines features like order protection and money management to minimize the drawdown while increasing profitability. According to the seller, the robot doesn’t use dangerous strategies like a martingale. Although the vendor’s claims sound good, we cannot trust them blindly. For this reason, we will dive deeper to evaluate the expert advisor’s crucial aspects, which will eventually help the investors make a better decision.

Pricing

The algorithm is available with an asking price of 249 Euros with provides trading privileges for one account. Unlimited keys are provided for 299 Euros. Even though there is a 14-day money-back guarantee the costs are too high.

Cosmonaut FX EA trading strategy

The algorithm trades whenever the instruments deviate from the center of a price channel. It works on 12 different currency pairs. Other than this the developers do not share any details of the game plan. There are no live records available on Myfxbook that we could use to analyze its history for ourselves.

How it works

Cosmonaut FX EA can be used by following the following steps:

- Buy the expert advisor from the developer’s official website

- Download the robot files on your computer

- Open MT4 or MT5 on your PC

- Drag the downloaded EA files into the charts section and enable auto-trading

Cosmonaut FX EA features

The expert advisor comes with the following features:

- Detailed installation instructions available

- 24/7 automated trading

- A 14-day moneyback guarantee

- Free updates and upgrades

- The algorithm can place trades on 12 symbols

Cosmonaut FX EA backtesting results

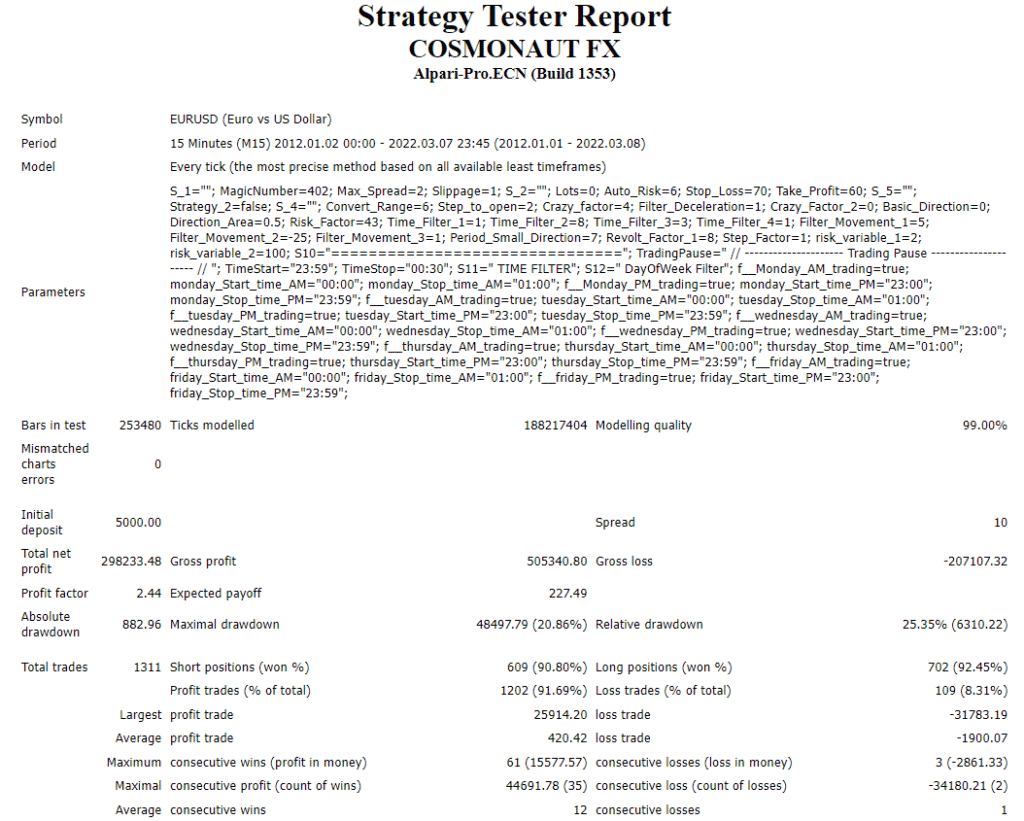

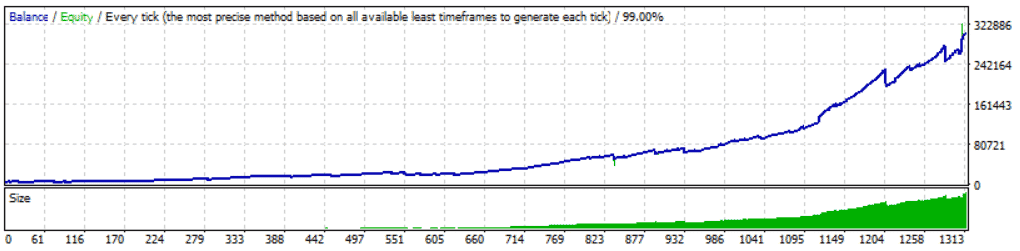

The developer shares the backtesting results of the EURUSD symbol in the M15 timeframe. The EA was tested for ten years of historical data between 2012.01.01-2022.03.08. The developer deposited the account with $5000 as an initial amount. The stats consist of 188217404 ticks with a history quality of 99.00%.

The relative drawdown was 25.35%, with a profit factor of 2.44. The system participated in 1311 trades, of which 1202 were winners, and 109 were losses. The average profit trade was recorded as $420.42, while the average loss trade was at -$1900.07, exhibiting the system’s high-risk strategical approach.

Cosmonaut FX EA live trading records

Unfortunately, the expert advisor doesn’t come with any live trading signal or records. This kind of behavior exhibits the nonseriousness of the developer towards their profession. The traders use the live trading stats to know the profitability, strategical game plan, and current performance of the robot in real market scenarios. The non-availability of essential data creates doubts about the credibility of the EA among investors.

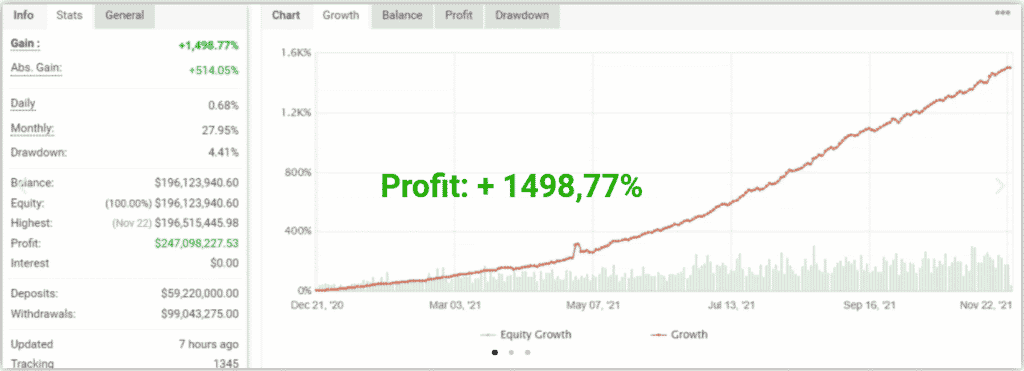

The vendors do attach a few screenshots on their website of an account from Myfxbook. After our research, we didn’t find any account associated with the algorithm’s name on Myfxbook. There is no evidence of the legitimacy of the data provided below.

Nevertheless, let’s analyze what we have. The bot placed its first trade in the last month of 2020 and ended in January 2022. The account was initially funded with a deposit of $59220000 which gave a profit of $247098227.53. The absolute gain of the bot is at 1498.77%, with a drawdown value of 4.41.

Low drawdown

The drawdown value of the system is 4.41, which is considered reasonable compared to other automated solutions available. However, the credibility of the live record is still doubtful as no system on Myfxbook with that name is present.

Cosmonaut FX EA reputation

We could not find customer feedback on third-party websites such as Quora, Trustpilot, Forex Peace Army, etc. The product is not very popular among the traders, which is evident from no user reviews..

Cosmonaut FX EA review summary

| Strategy | 4/10 |

| Functionality and features | 5/10 |

| Trading results | 3/10 |

| Reliability | 4/10 |

| Pricing | 5/10 |

The presentation of Cosmonaut FX EA lacks a clear insight into the strategic logic and a proper explanation of the game plan. The system comes with backtesting records over ten years, but the performance isn’t satisfactory. The credibility of live trading records is also questionable and the little information present on the whereabouts of the developer is also a red flag. The absence of users’ interest and testimonies over reputed websites also makes us blind to the overview of their experience.