China Asset Management Ltd.’s CSI 300 Index ETF grew to $2.7 billion in assets as of Tuesday, according to Bloomberg. The value surpasses BlackRock’s iShares fund tracking the FTSE A50 China Index.

- China’s ETF rise reflects investors looking to ride a surge in equities while avoiding a U.S. clampdown.

- CSI 300 buyers have also been attracted to the index’s broader holdings, compared to the finance-heavy FTSE A50.

- ETF investors are also trying to avoid the confusion following the U-turns of fund managers in response to the U.S. measures.

- BlackRock, the world’s largest fund manager, has been selling stakes in three Chinese telecommunication providers, including China Telecom Corp., after the U.S. put them on its sanctions list.

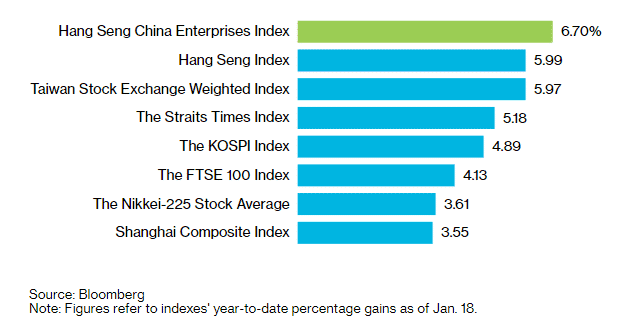

- Other Chinese Indexes have also gained, with Hang Seng jumping 10% in 20201, the most of any developed market this year.

Chinese stocks are currently gaining. CSI 300 is up 0.72%, HSI is up 1.08%, HSCEI is up 1.83%