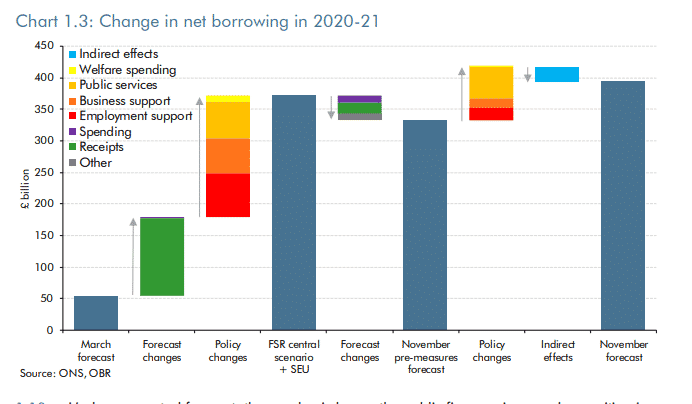

Britain’s borrowing is forecasted to reach a total of 394 billion pounds this year, or 19% of GDP, the highest level in peacetime history, according to the Office for Budget Responsibility press release. The economy will contract by 11.3% in the year, the most significant plunge for 300 years on coronavirus impacts.

- Despite the economic contraction this year, Britain projects a recovery of 5.5% in 2021, 6.6% in 2022, 2.3%, 1.7%, and 1.8% in each of the following years.

- The government’s borrowing will fall to 164 billion pounds in 2021, 105 billion pounds in 2022 and 2023, and 100 billion pounds, or 4% of GDP, for the remainder of the forecast period.

- Gross domestic product (GDP) will remain below the pre-crisis levels until the fourth quarter of 2022

- Britain’s economy will be about 3% smaller in 2025 than projected in the government’s March budget.

- The underlying debt, not incorporating the Bank of England’s asset purchase program’s temporary impact, is forecast to be 91% of GDP this year and rise steadily to 97.5% in 2025 and 2026.

- The unemployment rate will rise to a peak of 7.2% or 2.6 million people in Q2 2021 and fall steadily to 4.4% by the end of 2024

- Capital expenditure on infrastructure will total 100 billion pounds in 2021, a 27 billion pounds increase from last year.

- British Finance Minister Rishi Sunak announced 280 billion pounds in public spending to guide the country through the pandemic’s aftermath.

- Sunak also announced a further 3 billion pounds for the Department of Work and Pensions (DWP) to deliver a “three-year restart program” to help more than 1 million unemployed to get back to work

- U.K. economy grew by a record 15.5% in the third quarter after a 19.8% plunge the previous quarter

U.K. stocks are currently declining as the pound gains. FTSE 100 is down 0.63%, GBPUSD is up 0.08%