As a forex trader, it is natural for you to look for a trading approach that gives you more returns with minimal risk. But finding the right approach is not that easy. You need to experiment with different formats before you can find one that works. Luckily, the automated systems in Forex trading offer a big advantage. They use time-tested and proven approaches and settings.

But not all Forex robots are similar in the results they deliver. You need to analyze various aspects of the system before you can decide on using it. Here we have done a detailed review of the Blueshift MT4 advisor. This system is fully automated and ideal for Intraday trading. Priced at $399, the system is also available for monthly rental, which costs $369. The vendor also provides a free demo version for users to try the system.

Blueshift Trading Strategy

Based on the vendor info, the system uses the Ma and Wpr indicators for its trading approach. The vendor claims that the system is capable of making a greater number of winning trades with the approach it uses.

Explaining the strategy, the vendor states that the approach begins with a market order in counter- trend and also trend following all of which are done based on the analysis of the expert advisor. The vendor also claims that the system does not use high-risk approaches such as Martingale or Grid. It focuses on the real take-profit and stop-loss features.

Blueshift Features

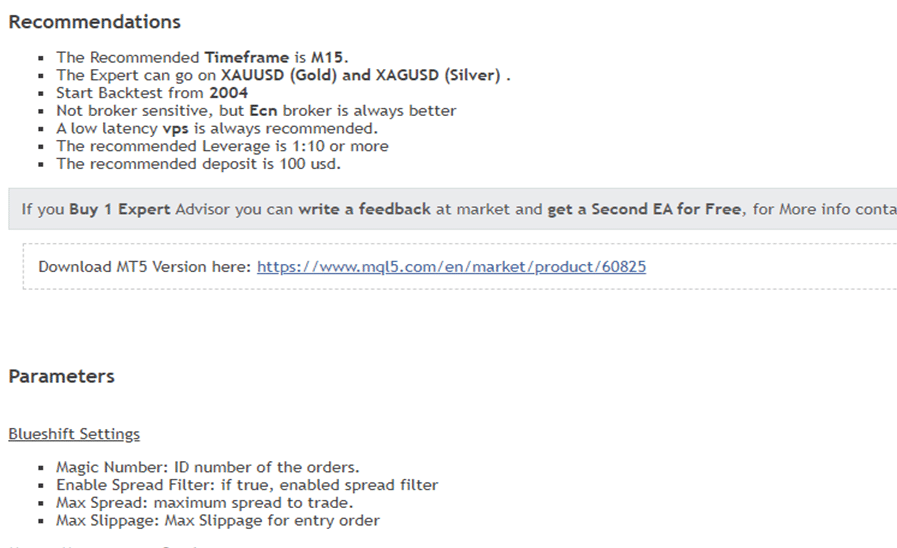

The system focuses on the XAUUSD and XAGUSD pairs. While the vendor mentions that it is not broker sensitive, the ECN broker is recommended for better performance of the system. The leverage used for this system begins at 1:10. A minimum deposit of $100 is needed for trading using this expert advisor.

Settings for the Blueshift EA include maximum spread, maximum slippage, spread filter, and magic number. Money management is part of the features provided and includes risk percent, lots, and money management settings.

Blueshift Backtesting Results

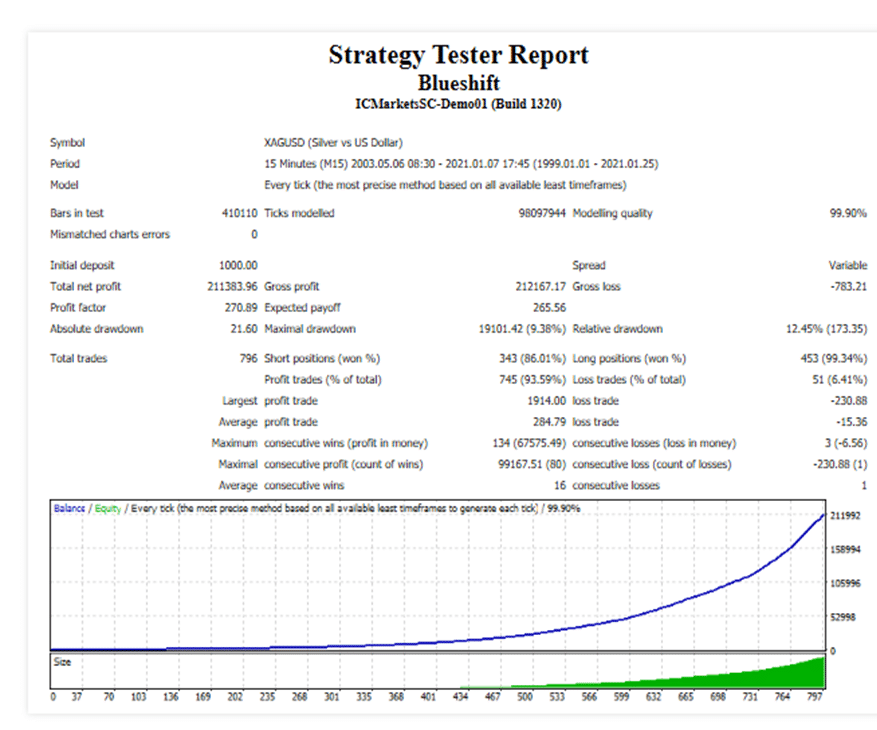

A strategy tester report for this robot is made available on the MQL5 site. The screenshot below shows the backtesting done.

A timeframe of M15 was used for the backtesting. The modeling quality was 99.9%. This level of accuracy is required to find out the actual spread, slippage, commissions, and other important details. The backtesting for the XAG/USD pair was started in 2003. An initial deposit was $1000. The profit factor was 270.89 and the maximal drawdown was 9.38%.

Blueshift Live Trading Results

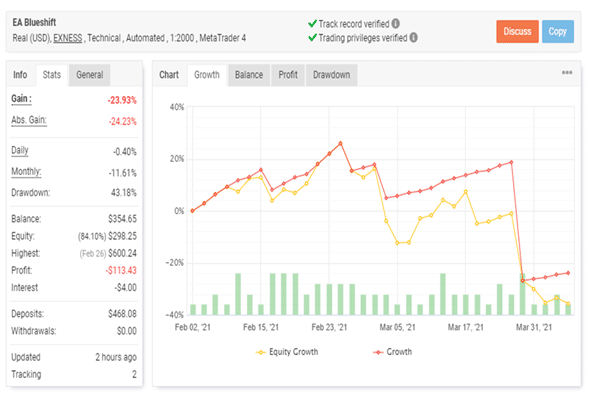

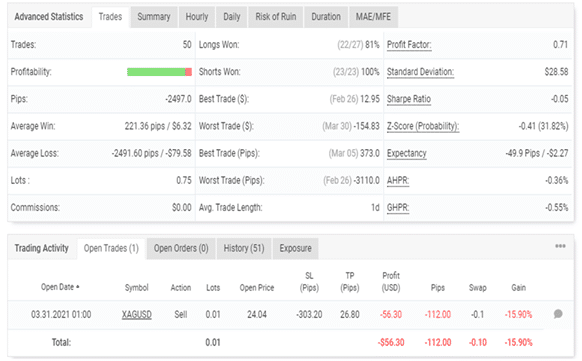

We could not find live verified trading results for this system on the official site. The developer mentions performance displayed on his profile page. But the profile page does not reveal live verified results. However, we found a real account verified on the myfxbook site. Here is a screenshot of the trading results:

From the real USD trading account using the leverage of 1:2000, we find the system is registering a loss of 23.93% and an absolute loss of 24.23%. The daily and monthly losses recorded include 0.40% and 11.61% respectively. With a drawdown of 43.18% we find the system to be a very high-risk type. For the trading account started in February 2021, there are a total of 50 trades done with average trade length being one day. The profit factor is very low at 0.71.

Blueshift Reputation

Marco Solito is the developer of this system. Published in January 2021, this system is one of the many products developed by Solito. The developer is from Italy and the other products include Dark Oscillator, Redshift, and more. We could not find further information about the developer. Support for the system can be received by contacting the developer. This system comes under the experts’ category so newbies or traders with very little experience should avoid the system.

We were unable to find reviews from users for this system on reputed sites such as Forexpeacearmy, Trustpilot, etc. While there are several reviews posted on the MQL5 site, they have a high chance of being manipulated. Without genuine user reviews, we are not able to analyze the system fully.

Blueshift Review Summary

Overall rating- 5.5/10

- Strategy – 5/10

- Functionality & Features – 5/10

- Trading Results – 4/10

- Reliability – 6/10

- Pricing – 5.5/10

Conclusion

Summing up our review of the Blueshift MT4 expert advisor, the system focuses mainly on gold and silver making it an exclusive system. Furthermore, since the vendor categorizes it under expert level, many traders will not find it useful. The trading results show a poor performance with a high drawdown. The short sample size may be a reason for the poor trading results.But the backtesting report shown reveals a high profit and a very low drawdown percentage. We also found the profit factor to be a bit overboard at 270.89. Considering that the backtests are from historical data that bears no significance on the future performance of the system, the report does not add to the benefits of this system. With more transparency in the strategy, support, and better performance results, we could consider this system as a viable one.