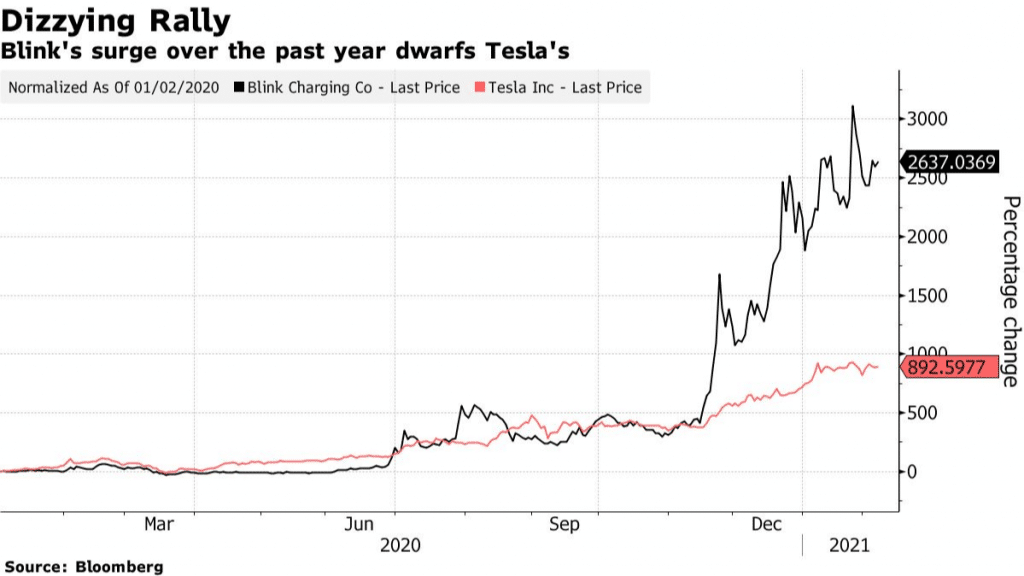

Blink Charging Co. share has gained more than 3,000% over the past eight months despite having never posted an annual profit in its 11-year history, according to Bloomberg. The green-energy company is riding on the mania sweeping through green companies as investors consider them as must-own investments of the future.

- Last year, Blink warned it could go bankrupt and lose the market share amidst management turnovers in recent years.

- With a market cap of $2.2 billion, Blink’s enterprise value-to-sales, a ratio that shows whether a stock is overvalued, has jumped to 493.

- Andrew Left, the founder of Citron Research, says everything about Blink is wrong despite the stock catching the eye of retail investors.

- Overall short interest on Brink, a measure of investors against the stock, has fallen to under 25% of free-floating shares from more than 40% in late December.

- With estimated revenue of $5.5 million in 2020, analysts believe Blink’s charging market is still small and early-stage and will take time for economies of scale to materialize.

- The surge of Blink’s stock has seen the company raise $232.1 million through a share offering in January and has discussed plans to develop about 250,000 charges “over the next several years.”

- Currently, Blink has 6,944 charging stations in its network, far much below its rival ChargePoint, with a charging network more than 15 times larger.

- Investors raise concern that Blink’s revenue model of driving up utilization rates remain in the “low-single-digits” and could fail to drive significant revenue.

Blink stock is currently gaining. BLNK: NASDAQ is up 6.62%