Bitcoin Surges Ahead of Trump Inauguration; Korean Markets Eye Policy Risks

In a day marked by global political shifts, ‘bitcoin’ reached a new peak, while markets in[[3]South Korea braced for uncertainty ahead of Donald Trump’s inauguration as U.S. President.

Bitcoin’s All-Time High

Just before Trump took office, the price of bitcoin surpassed 160 million won, soaring to an all-time high. Even ‘meme coins,’ including one themed around Trump, skyrocketed by a factor of 12 over the weekend. Speculations swirled that the Trump administration might designate bitcoin as a strategic national asset.

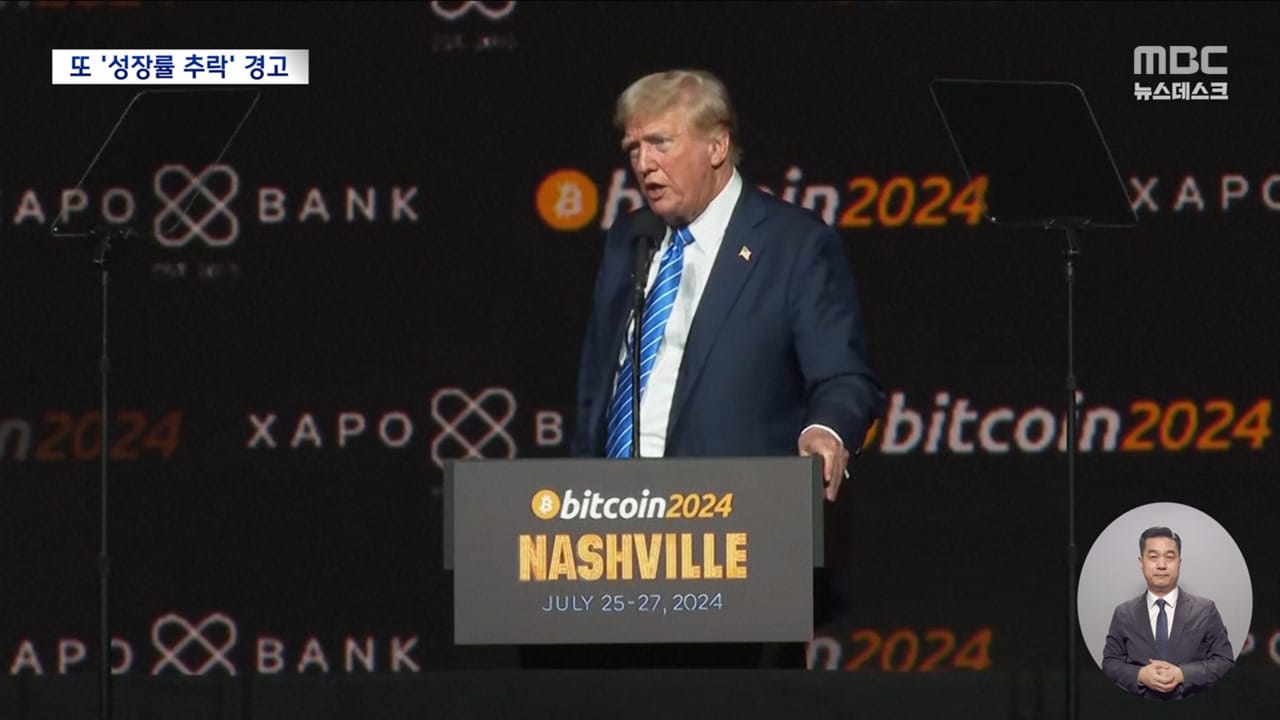

Trump, then a presidential candidate, had once remarked, “The value of Bitcoin is going to skyrocket, and I want America to lead the way.”

South Korean Markets: Cautious and Wary

Across the Pacific, South Korea’s stock market held its breath, apprehensive about the executive orders Trump was set to sign. Chief among concerns were tariff barrier implementations, electric vehicle, and semiconductor support law repeals — ticking time bombs that could reshape the economic landscape.

Acting President Choi Sang-mok advised, “From now on, uncertainty will morph into ‘policy risk.’ The first days of Trump’s administration will be a ‘golden period’ for investors to gauge the new president’s direction.”

Bank of Korea’s Downgraded Growth Projections

Meanwhile, the Bank of Korea trimmed its 2021 economic growth forecast to a range of 1.6% to 1.7%. This revision, made a month earlier than usual, cited ‘unexpected political risks’ and uncertainty, following South Korea’s declaration of martial law and the passage of the second impeachment bill against President Yoon Seok-yeol.

Consumer sentiment and business confidence indices also softened in December, with the uncertainty index spiking during political turbulence.

In an analysis, Korean Bank official Kim Dae-yong noted, “Domestic political uncertainty and sentiment contraction are dampening domestic demand by around 0.2 percentage points.”

As investors worldwide navigate political headwinds, the fate of markets rests on policy clarity and stable political environments.

understanding the interplay between political events and financial markets is vital for navigating periods of uncertainty. As demonstrated by the surge in Bitcoin amidst political shifts and the cautious stance of South Korean markets, global trends can considerably impact local economies.

FAQ

What is Bitcoin? Bitcoin is a decentralized digital currency, operating independently of any central bank or government.

Why is market sentiment important? Market sentiment reflects the overall attitude and expectations of investors, which can influence trading decisions and price movements.

We want to hear from you! Share your experiences or feedback about market reactions to political events in the comments, and let us know how this article helped you.

as Bitcoin reached unprecedented heights in the shadow of Trump’s inauguration, global markets grappled with the implications of this historic moment. While the fervor surrounding Bitcoin’s newfound valuation may be fueled by speculation about pro-crypto policies under the new management,[See[See[]] the cautious demeanor of South Korean markets highlights the ongoing uncertainty surrounding the future of cryptocurrency regulation. The possibly volatile interplay between global political upheaval and the burgeoning cryptocurrency landscape will undoubtedly continue to captivate investors and policymakers alike in the months to come.