XTB is a safe multi-asset broker with over 15 years of experience that serves customers from all regions worldwide through its powerful xStation 5 platforms. In addition, the multiple regulations from top-tier regulatory bodies like FCA ensure that client’s funds are kept secure. Overall, the broker offers its users a great trading experience, with educational resources and many features.

Pros

- Multi-regulated forex and CFD broker

- Over 5200 trading instruments

- Low forex fees

- Straightforward account opening process

Cons

- Limited access to fundamental data

- Product range limited to forex and CFDs

- High stock CFDs fees

X-Trade Brokers (XTB) was founded in 2002 as X-Trade. It was the first leveraged forex brokerage institution in Poland. In 2004, it morphed into XTB in compliance with Polish new financial regulations. It has operated as XTB online trading since 2009. It’s also listed for public trading on the Warsaw Stock Exchange under the symbol XTB.

XTB is an award-winning global CFD and FX broker, recognized for its excellent features, outstanding customer service, and a large selection of trading and research tools. It offers clients over 5200 financial instruments to trade on, mainly CFDs.

Regulation

XTB is regulated by tier-1, tier-2, and tier-3 institutions, making it safe for investors. Since the broker offers services to customers in different regions worldwide, the regulations are imposed per region by institutions in those regions.

The supervising agencies for the XTB subsidiaries regulate as follows.

- XTB Europe — CySEC (license number 169/12 as of 2020).

- XTB España — Comisión Nacional del Mercado de Valores (license number 40).

- XTB UK — Financial Conduct Authority (license number 522157).

- X-Traders Brokers DM SA — Polish Securities & Exchange Commission (license number 4021-57-1/2005).

- XTB International — Belize International Financial Services Commission (license number IFSC/60/413/TS/19).

Any funds belonging to clients are kept separate from the company’s funds and protected under the UK’s FCA guidelines. The Financial Services Compensation Scheme (FCSS) ensures that clients are compensated for amounts up to 85,000 GBP.

XTB accepts investors from most countries worldwide except Canada, Japan, Singapore, Kenya, Slovakia, United States, Australia, Ethiopia, Pakistan, India, Cuba, Mauritius, Syria, Israel, Romania, Turkey, Iran, Uganda, Iraq, and Bosnia and Herzegovina.

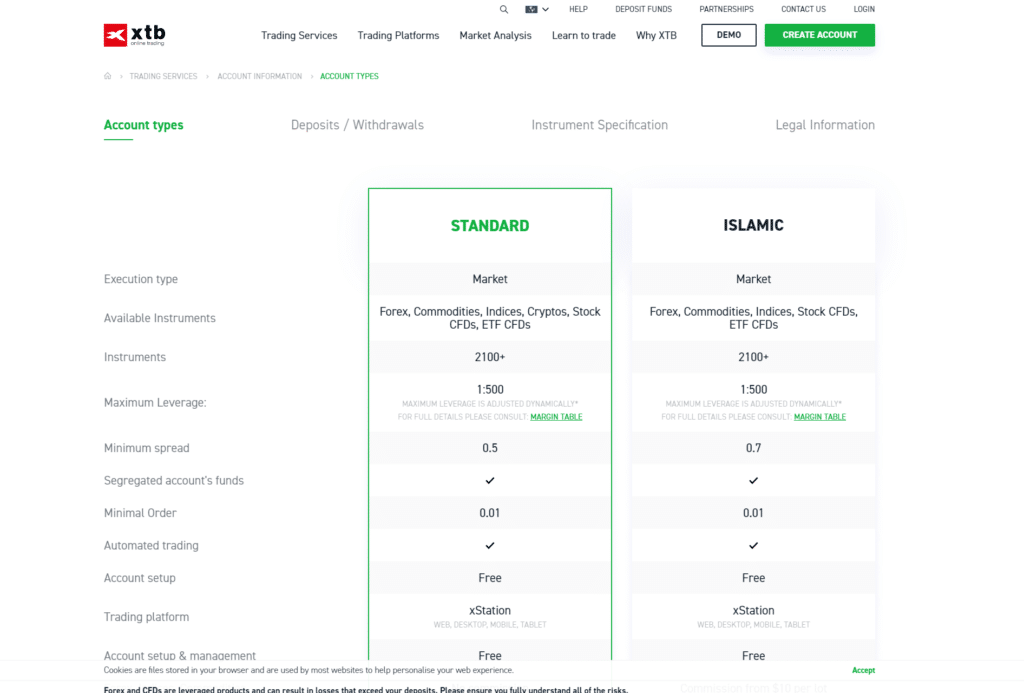

Account Types

XTB serves its clients in two different account types: a Standard account and a Pro account. It also has an Islamic account that is Sharia-compliant to serve Muslim clients. The accounts differ in the fees and commissions charged.

| Standard account | Pro account | Islamic account |

| Trading platforms — xStation (desktop, web, and mobile) Trading tools — forex CFDs, Commodities, Indices, Crypto, Stocks, and EFTs Maximum leverage — 1:30 Minimum spread — 0.9 pips Minimum deposit — $0 The commission per lot — $0 | Trading platforms — xStation (desktop, web, and mobile) Trading Tools — forex CFDs, Commodities, Indices, Crypto, Stocks, and EFTs Maximum leverage — 1:500 Minimum spread — 0 pips Minimum deposit — $0 The commission per lot — $3.5 | The Islamic account is available in the XTB International subsidiary for clients in select countries such as Saudi Arabia, Lebanon, Jordan, Oman, UAE, Qatar, Malaysia, Kuwait, Bahrain, and Egypt. Clients in the EU and the UK can not open an Islamic account. Trading Platforms — xStation (desktop, web, mobile) Trading Tools — forex CFDs, Commodities, Indices, Crypto, Stocks, and EFTs Maximum leverage — 1:500 Minimum spread — 0.7 pips Minimum deposit — $0 The commission per lot — $0 |

How to open an XTB account?

The 5-step process is straightforward, and you’ll have your account ready in about 30 minutes. The verification process will take about 24 hours, and you’ll be fully set to make profits on your account.

Step 1. Provide your valid email address and choose your country from the drop-down menu.

Step 2. Enter the required personal information like your birth date in the provided application form.

Step 3. Choose your preferred account type, trading platform, and base currency.

Step 4. Provide correct answers to the KYC questions. They’ll ask about your employment status, trading experience, and current financial status.

Step 5. Use the available account verification channels to verify and activate your account.

Fees and Commissions

XTB charges both trading and non-trading fees, and these fees vary for both account types. For example, standard accounts only charge spreads, while pro accounts pay both spreads (market range) and commissions.

Spreads for a standard account range from 1.2 to 0.9 pips, while on a pro account, they can go as low as 0 pips. Trading CFD EFTs and CFD stock commissions attract a commission of 0.08% for every open and close position of every transaction.

Compared to other brokers, XTB charges low forex fees and considerably high stock CFD fees.

Other fees may include:

- Inactivity fee — €10/month after one year of account inactivity.

- Withdrawal fee — $20 for all withdrawals less than $100. Withdrawals above $100 are free.

- Deposit fee — a 2% charge on deposits via e-wallets. Deposits through bank transfer, credit and debit cards are free.

Payment options

XTB accepts transactions in the following base currencies: EUR, GBP, USD, and HUF. Many deposit methods are acceptable on XTB, and you can choose one that works best for you.

Deposit methods

XTB accepts deposits through bank transfers, electronic wallets, and credit/debit cards. There’s no deposit fee charged when you deposit through your credit/debit card and bank transfer. However, a 2% fee will apply to all deposits done through electronic wallets.

The e-wallets options include:

- Paysafe

- PayPal

- Sofort

- Paydoo

- PayU

- Bilk, etc.

The choice of the e-wallet depends on your country of residence and its availability there. For example, only German clients can use Sofort, but clients from different countries can use Paysafe.

Deposits via e-wallets and credit/debit cards are instant, but bank transfers delay for about two days. If you want a faster deposit through bank transfer, you can contact XTB support so that they can speed up the process.

Withdrawal methods

XTB allows withdrawals through bank transfer only. A withdrawal fee of $20 applies for amounts below $100. The company is aware that clients may want to withdraw small amounts depending on their account balances, so it has set different thresholds for such withdrawals.

Once you initiate a withdrawal, it is processed within one business day. If the withdrawal is made before 1 pm, the amount reflects in the bank within the same day. Otherwise, your money will reflect in your bank the next day.

Available Markets

XTB offers over 5200 trading instruments that you can trade as CFDs. You can also trade cryptocurrencies and forex. Since the broker is primarily a CFD and forex trading platform, its default settings feature CFDs and forex.

Clients residing in European countries have an opportunity to trade real stocks and EFTs as other regions trade them as CFDs. Here’s a list of the different financial instruments on XTB.

- Forex

Trade over 48 currency pairs, including the major pairs, some minor and exotic pairs on XTB. The forex-supported CFDs have reduced spreads of 0.1 pips and a leverage of 1:30.

- Indices

Trade over 40 tools of CFDs with index support on XTB with spreads of 0.24 pips and a leverage of 1:20.

- Commodities

The broker offers over 20 tools of commodity-supported CFDs with no costs for any trading positions holding overnight. That means traders can continue trading for 24 hours at no extra charges. The maximum leverage is 1:20.

- Cryptocurrencies

XTB offers 25 crypto assets, with 16 being pairs and 9 being individual coins. Some of the coins available are Bitcoin, Dash, Ethereum, Litecoin, and Ripple. The maximum leverage is 1:2, and traders can trade all through the week’s seven days.

- Stocks

On XTB, over 2000 listed shares are listed for you to choose from and invest at 0% commission. You get to invest in giant companies like Amazon, Tesla, Netflix, etc.

- EFTs

Invest in over 200 EFTs globally at no commission, ranging from companies, real estate, and other commodities.

Trading Platforms

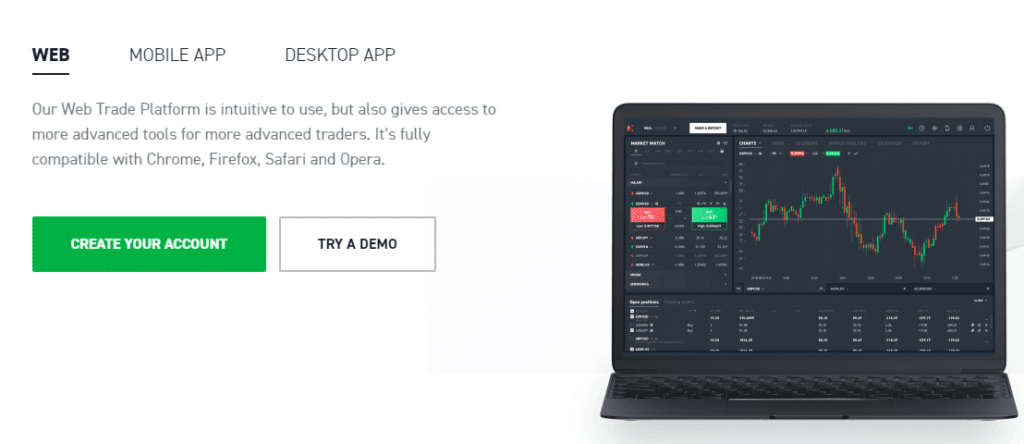

XTB runs on the excellent xStation 5 trading platform. It stands out for its superfast execution, ease of use, and reliability. It’s available on the web, desktop, and mobile applications.

The web platform is intuitive and user-friendly. Veteran traders take advantage of the web platform to access more features useful for efficient trading. You can access the web platform safely on compatible browsers like Chrome, Opera, Firefox, and Safari.

The XTB mobile app offers clients the convenience to trade anywhere on the go. It’s fully equipped with all the features that are necessary for a smooth trading experience. There’s a downloadable version for Android and iOS devices.

The desktop version comes with all the features and functionalities available on the web platform. The downloadable versions are compatible with Windows and macOS devices.

The platform can be accessed in languages like Czech, German, Romanian, Portuguese, French, English, Polish, Russian, Spanish, Turkish, Thai, Slovak, Hungarian, Vietnamese, and Arabic.

Pros

- Intuitive and user-friendly

- Innovative design

- Good search function

Cons

- No two-factor authentication for extra security.

Features

XTB has impressive features that ease trading for investors. They include:

- Charts

XTB has over 35 technical indicators and charting tools for easy chart editing and saving.

- News

The news flow segment provides short-term trading ideas to clients based on technical analysis.

- Negative balance protection

This feature protects clients from incurring charges below their zero account balance.

- Fundamental data

You can only access limited fundamental data like the debt-to-equity ratio. Also, there’s no way to access financial statements.

- Economic calendar

It’s a feature that shows upcoming events and their historical data. This helps you prepare on time to take advantage of the market conditions at that time.

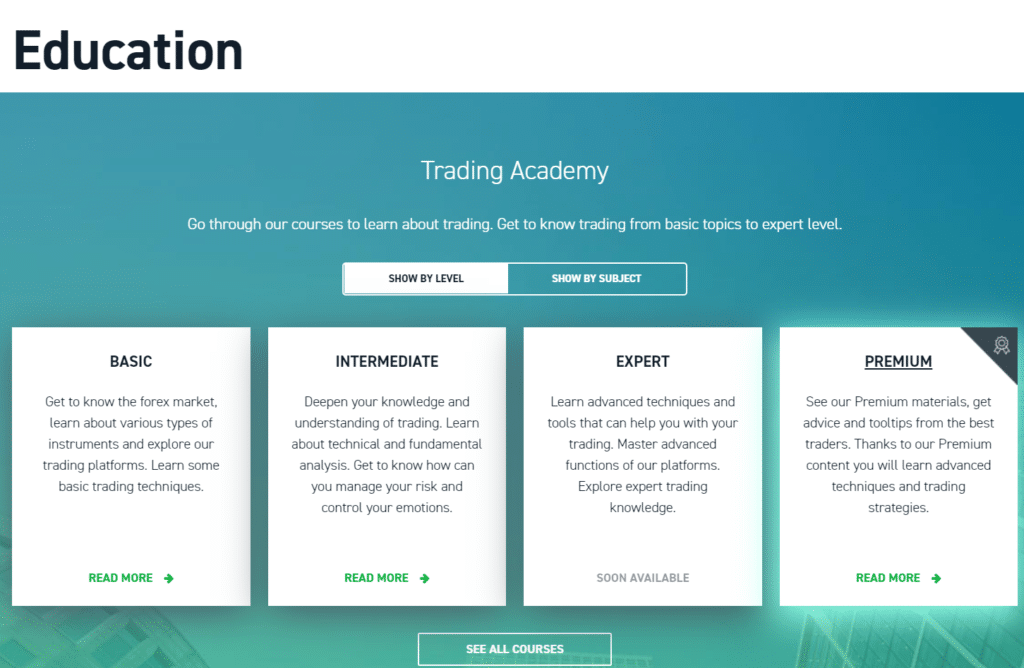

Education

XTB has an organized education system for all its clients. It has both written and video materials, as well as other tutorials on the platform. These materials include:

- Demo account

- Webinars

- Platform tutorial videos

- EBooks and educational articles

- General educational videos

At the same time all analytical materials provided by the broker are exclusively in English.

Customer Support

You can contact XTB’s customer service through a live chat on the website, phone, and email. The live chat is perfect for quick and relevant answers while trading on the site.

The phone support is also good. The agents answer the phone instantly and courteously respond to all your queries. The email is best for long-form questions that require long answers. The emails are responded to in a few hours, followed by a phone call from the staff to ensure you get a solution to all your questions.

Review Summary

XTB is a broker regulated by top-tier financial institutions. It charges relatively low forex fees, with fast deposit and withdrawal methods. Clients can practice on the demo account before they start trading live.

Stock CFD fees are quite high on the flip side, and the market product range features FX and CFDs only. Real stocks and EFTs are limited to clients in the European region. Also, the account security is not too strong as there is no two-step authentication.