Walmart shares fell more than 5% in premarket after reporting record quarterly revenue of $152.1 billion, a 7.3% increase, according to the company’s press release. The stock slip was fueled by the retailer’s warning that it expects sales to moderate this year while earnings per share will fall slightly.

- Walmart reported a net loss of $2.09 billion or GAAP EPS in Q4 of ($0.74), down from earnings of $4.14 billion or $1.45 per share a year earlier.

- Loss in the retailer’s U.K and Japanese operations reduced earnings by $2.66 per share, which was partially offset by a gain of 49 cents per share on equity investments.

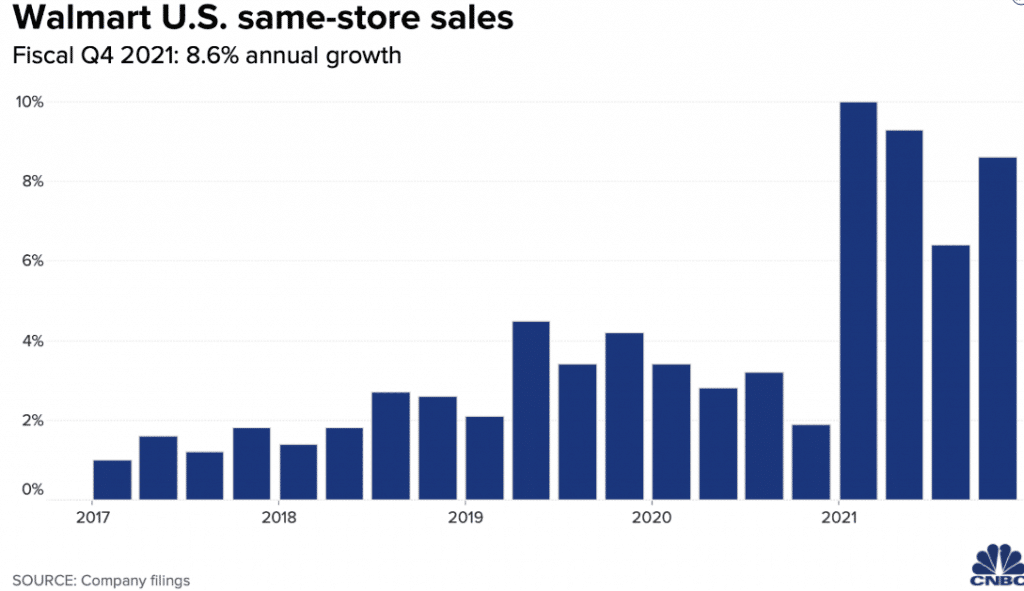

- Walmart’s e-commerce sales in the U.S. grew by 69%, while same-store sales in the U.S. grew by 8.6%, higher than expected 5.8% increase.

- The retailer targets $14 billion in capital expenditures this fiscal year, up from $10 billion to $11 billion.

- Covid-related expenses rose to $1.1 billion in Q4.

- The retailer faces tailwinds from decelerating pace of e-commerce as the global health crisis fades, turning thriving parts of its business such as curbside pickup into money-makers.

- Walmart will boost the wage of U.S. workers, raising the average for hourly employees to above $15 per hour.

- The retailer raised its dividend to 55 cents per share and approved a $20 billion stock buyback program.

Walmart stock is currently declining. WMT: NYSE is down 5.84%