The S&P 500 is hovering near its all-time high as its bullish momentum accelerates. The index closed at $4,291, its 32nd record close this year. It has jumped over 40% in the past 12 months and by 16% this year.

Interest rates fears fade

The S&P 500, Nasdaq 100, and Dow Jones indices have continued surging as investors ignore the potential for high interest rates in the United States (US).

In its June monetary policy meeting, the Federal Reserve sounded relatively hawkish as the US economy continued to recover. The bank said that it expects to start raising interest rates in 2023, earlier than the previous 2024. Some members of the committee suggested rate increases to start in 2022.

In theory, the S&P 500 and other indices should underperform in a hawkish market environment. However, these indices have mostly gained because investors believe that revenue and earnings growth will help to offset any interest rate increases.

In a recent report, analysts at FactSet said that a record number of S&P 500 companies were issuing positive earnings-per-share (EPS) and sales guidance for the second quarter. The report said that 103 companies have issued positive EPS guidance, higher than the historical average of 100. Eighty-five firms have issued positive revenue guidance, higher than the historic 77.

Strong economic data

The S&P 500 has also gained because of the recent strong American economic data. On Tuesday, data by the Conference Board showed that the overall consumer confidence increased from 120 in May to 127 in June. This increase was better than the median estimate of 119. Strong confidence is a positive sign since it sends a signal that the American consumer will ramp up consumption.

Further data revealed that the house price index (HPI) rose by 14.6% in April after rising by 13.3% in March. This was the strongest number in more than 30 years and is a sign that the housing market is strong. Indeed, recent numbers reveal that there is an ongoing housing shortage in many American markets.

The next top catalyst will be the upcoming US non-farm payrolls data. Analysts expect the data to show that the economy added more than 200k jobs in June while the unemployment rate declined to 5.6%.

The S&P 500 is also rising because of the banking sector. This week, many big American banks announced a significant increase in their dividends. On Tuesday, JP Morgan increased its quarterly dividend to $1 per share from the previous 90 cents.

This came after Morgan Stanley doubled its payout and increased its buyback program. Goldman Sachs increased its dividend by 60%. Wells Fargo doubled its dividend and increased its buyback program to $18 billion. This is happening after the banks passed the Federal Reserve’s stress test program. The banking sector has been one of the best performings in the S&P 500.

The index also rose after a strong sign of confidence from United Airlines. The company placed the biggest plane order from Boeing and Airbus on Tuesday.

S&P 500 index forecast

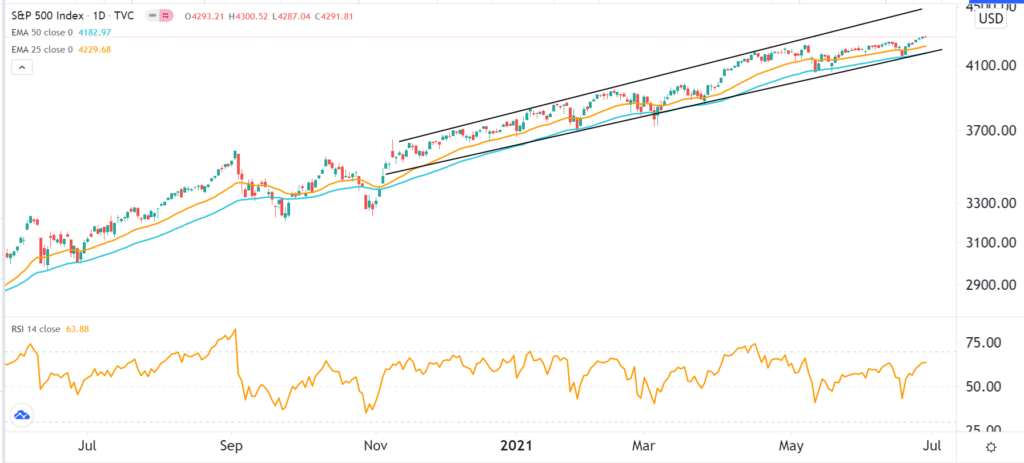

The daily chart shows that the S&P 500 index has been in a strong upward trend in the past few months. The index remains above the 25-day and 50-day Exponential Moving Averages (EMA). It is also capped within the ascending channel shown in black while the Relative Strength Index (RSI) has risen to 63.

Therefore, the index will likely maintain the upward trend as investors target the next psychological level at $4,500. However, a drop below the lower side of the channel at $4,150 will invalidate the bullish view.