Rombus Capital provides signals and managed account services for Forex investors and traders. The company claims to address the issues and challenges in the two service fields with its efficient services.

The vendor claims that you need $1000 for starting an account with the company. To use this service, it charges a performance fee of 40% from the monthly profits you make. There are three different types to choose from namely the retail, conservative and prime managed accounts.

The main difference in the packages is the minimum investment you need which ranges from 10,000 to 250,000 Euro or an equivalent amount. The company assures monthly returns of up to 20% and a maximum drawdown of 20%.

Rombus Capital Trading Strategy

The company does not divulge the strategy it uses to manage the accounts. Instead, it claims to use experienced asset managers who provide superior services to investors. It claims to deliver a respectable track record to its satisfied clients with its consistent results. Besides this vague info, we could not find details on the trading approach the service uses for managing the accounts.

Rombus Capital Features

As per the vendor, features offered include skilled money managers, safe investments, and transparent operations. The service offers low risk and claims to have traders with strong expertise and a proven track record to manage the accounts.

The company claims that customer centric approach, top-quality service, transparency, and flexible operations, and professional ethics are its core values. Investors are provided with prompt and free assistance whenever needed and the vendor states that the company remains equally unbiased to its traders and investors.

Rombus Capital Backtesting Results

There are no backtesting results found on the official site. Backtests help users to know about the efficacy of the trading approach and understand the risks and profitability better. Although the tests are based on historical data and do not predict a similar performance of the system in the future, traders prefer backtesting results. Backtesting plays a vital role in deciding whether a particular trading tool is effective or not. The absence of the results makes us suspect the reliability of the company.

Rombus Capital Live Trading Results

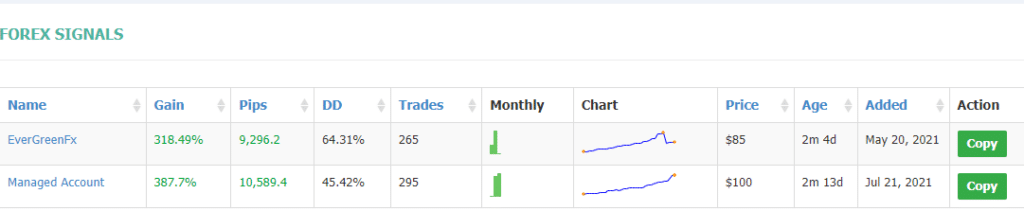

No verified trading results are present for this service. Instead, the company provides trading details shown below.

From the above trading details, we can see the managed account shows a profit of 387.7% and 10,589.4 pips with a drawdown value of 45.42% for a total of 295 trades. From the results, we can see that the drawdown is very high even though the account shows appreciable profits.

We prefer trading results verified by sites like Myfxbook, FXBlue, FXStat, etc. as they provide in-depth details of the trading account. Info like the balance, equity, absolute profit, profitability, lot size, and more can be found from the results. The absence of verified real trading results is another downside that makes us suspect this is not a trustworthy service.

Rombus Capital Reputation

As per the info found on the About Us page, the company practices the highest standards of principles and ethics while maintaining transparency and integrity. It claims to use the top asset managers for its clients. It is disappointing to note that there is no information related to the founding year, the location address, phone contact, etc.

For customer support, the vendor offers messaging via WhatsApp and Telegram and an online contact form. The insufficient support options and lack of vendor transparency further confirm our suspicions regarding the dependability of the vendor.

We found one review for this company on the Forex Peace Army site. The review mentions that the expert advisor is awesome and is excellent in trend following. Good customer support is also mentioned. Since the company provides social trading and managed account services mainly, the EA reference of the user is puzzling.

Rombus Capital Review Summary

- Strategy – 4/10

- Functionality & Features – 4/10

- Trading Results – 4/10

- Reliability – 4 /10

- Pricing – 5/10

Conclusion

Rombus Capital boasts of growing the wealth of its customers by its quality services in managed accounts and social copy trading. Our assessment of the company, its features, performance, pricing, and support reveal that it is not a reliable vendor. Since a proven track record is vital for assessing the efficacy of an FX trading tool, the failure of the vendor to provide verified results makes us suspect the reliability. The lack of vendor transparency, failure to reveal info on the trading approach and management, no backtests, and poor support are factors that confirm that this is an untrustworthy site that traders should stay away from.