Almost all the top traders, including ones sitting in prop firms, institutions, and banks, utilize technical analysis to some extent in their trading. The use of price action and indicators is an essential component for these market participants as they increase the overall probability of winning trades.

Indicators provide trading signals, position management, and predict market conditions. There are two types of indicators:

- Leading. They predict the future of market prices.

- Lagging. Consider them as the rearview mirror of your car as they show the current movement or progress based on past trends.

Benefits and demerits of indicators

Indicators have the following benefits for traders:

- Emotions. These tools help remove the human element as they give out signals depending on the coded algorithm. They can work without tiring themselves.

- Managing trades. Indicators are extremely helpful in managing your trades by determining your lot sizes, entry/exit points, etc.

- Flexibility. They are available on most charting platforms where you can employ them on different time frames.

- Probability. Using indicators correctly is beneficial in increasing the winning chance of your trades.

Whereas the demerits are:

- Fraud. Most of the indicators that claim to work like magic in trading are frauds. Novice traders are a good target for the developers of such tools.

- Lagging. Lagging indicators are not helpful for most as they show the history of prices.

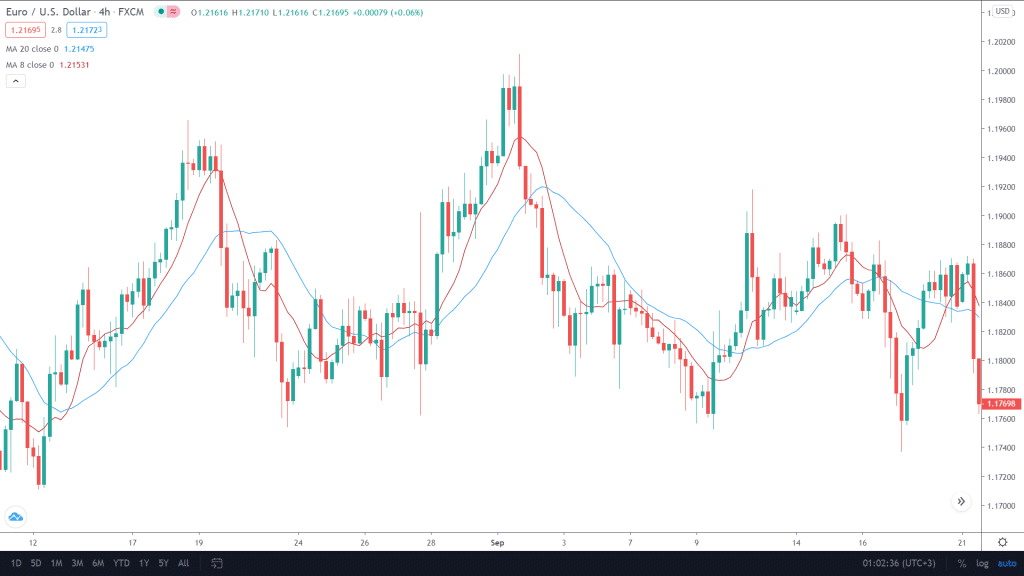

Moving averages in their essence

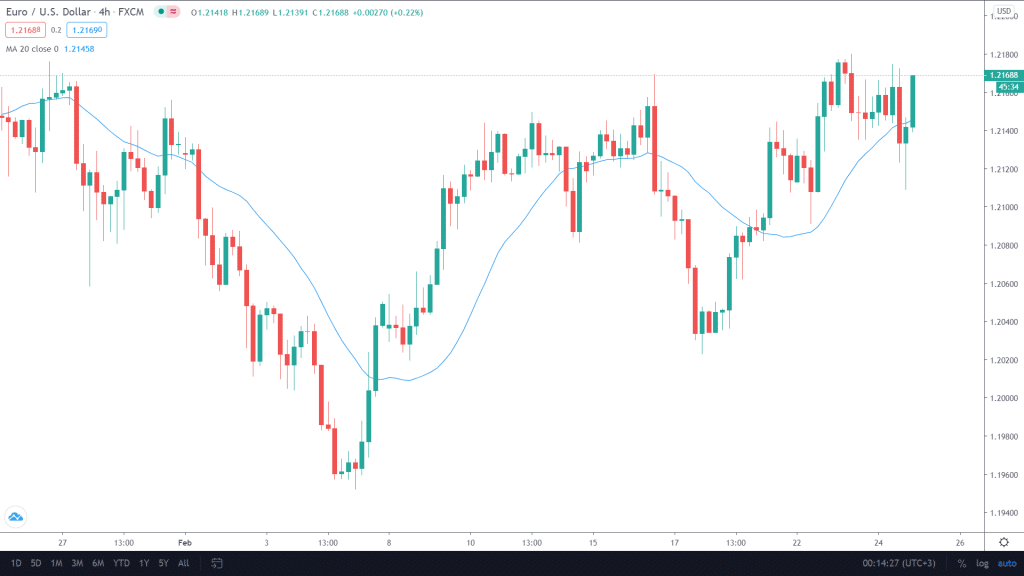

We come across G.U.Yule and R.H Hookers’ names as the developers of famous moving averages back in the early 1900s. The indicator stood out as a massive success and quickly became the favorite of technical traders. The tool helps remove the fluctuations in price by employing a line that shows previous candles’ mean. As you increase the number of bars, the moving average will become flattened as it looks deeper into history.

Image 1. A 20-period moving average on the H4 chart in EUR/USD.

There are three major types of moving averages that you should know about:

- Simple. The SMA or simple moving average is calculated by adding recent prices and dividing the result by the number of periods.

- Exponential. EMA focuses more on the recent fluctuations in prices and ignores the vast ups and downs in history.

- Weighted. The type of moving average follows the prices in a much closer way than SMA. It also focuses its attention on recent fluctuations.

Moving averages in practical application

You can use moving averages for the following purposes in your trading.

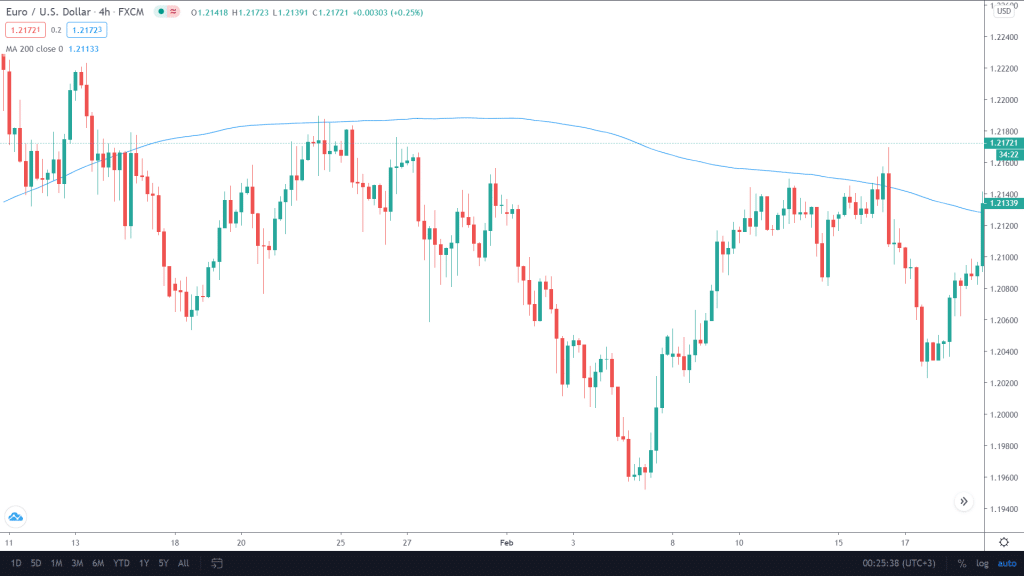

Support and resistance

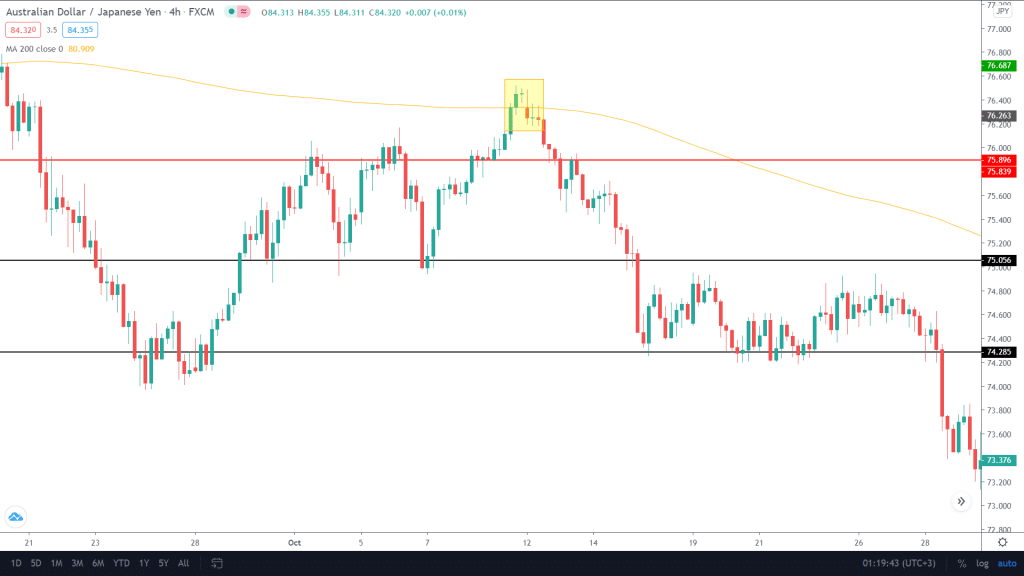

Different periods of moving averages are at hand for use as possible support and resistance levels. The most famous one is 200 period MA, and you can also utilize 50 and 20 MA for similar purposes.

Image 2. Look how the 200 period moving average acts as significant resistance.

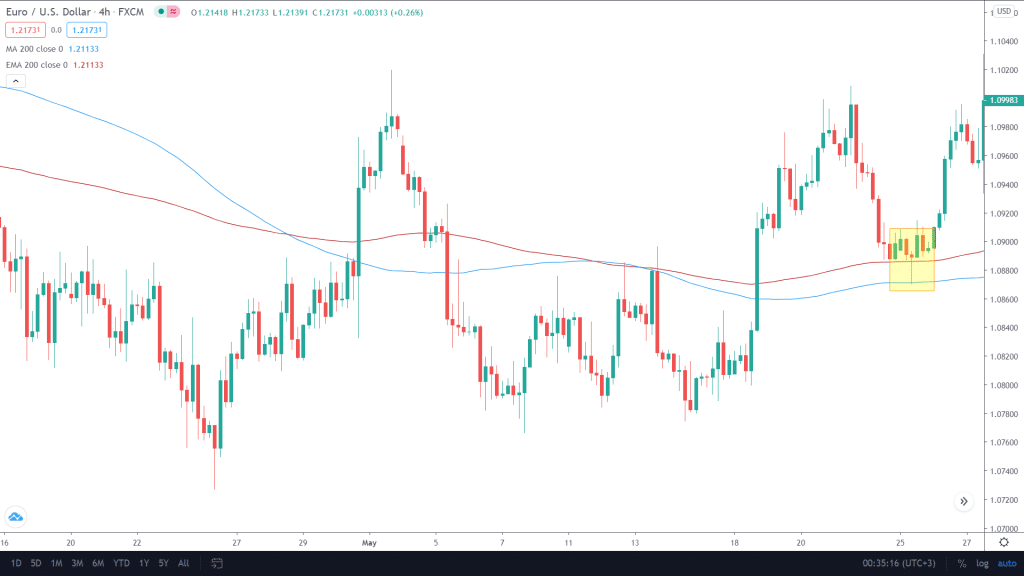

Fluctuations

Moving averages are an excellent tool for determining what the prices are doing as they remove the unnecessary noise. EMAs are vital in this regard.

Image 3: The red line represents the 200 EMA while the blue one shows the 200 SMA. Notice how the exponential moving average pinpoints the support at the exact point.

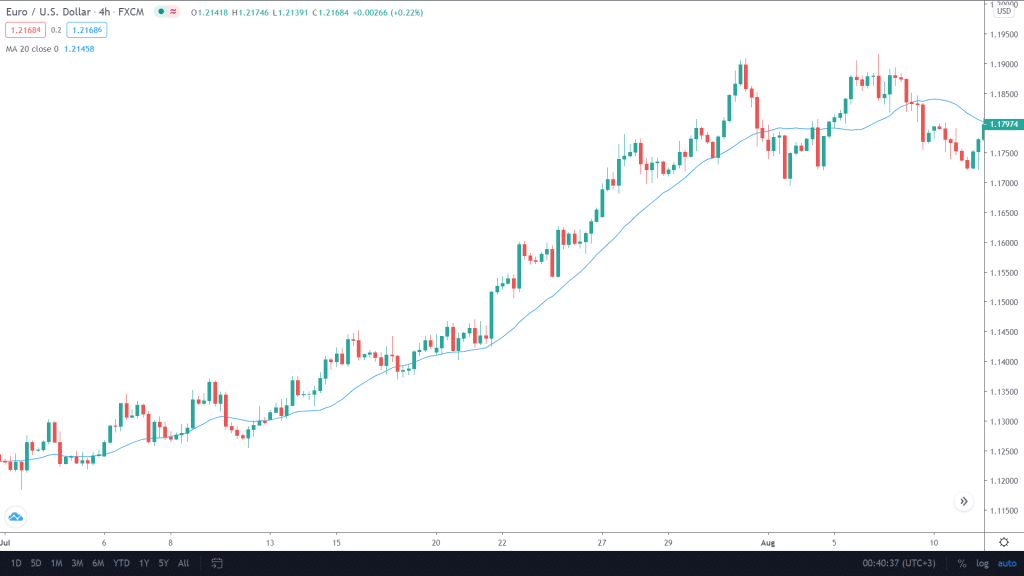

Momentum

Traders use the 20 MA for determining the momentum of the markets. If the instrument is trading above it and the line’s slope is in an upward direction, then participants look out for buy opportunities and vice versa.

Image 4. The price continues its uptrend with the support of a 20 period moving average.

Moving average strategies

Moving averages are indeed among the best indicators in the market to compliment your trading strategies. There are tons of tools and techniques that work well with MAs, provided you use the correct risk management and mindset. We have handpicked a few top game plans so that you don’t have to research yourself.

- Reversal. You do not need another indicator for this simple strategy, as moving averages will suffice themselves. Use the cross-over between 8 and 20 MAs for spotting potential reversals and going long or short subsequently.

Image 5. You might be able to identify the 8 and 20-period moving averages from the chart at this point. The one that follows the candles at their closest position is the 8 EMA, while the other is 20. The cross-overs result in market reversals.

- Price action. Moving averages help out price action traders as they show a good amount of confluence and winning setups with perfect risk/reward.

Image 6: A perfect short setup where the 200 period moving average acts as a resistance. The red line shows the daily key level, which confirms the trade alongside the current downtrend.

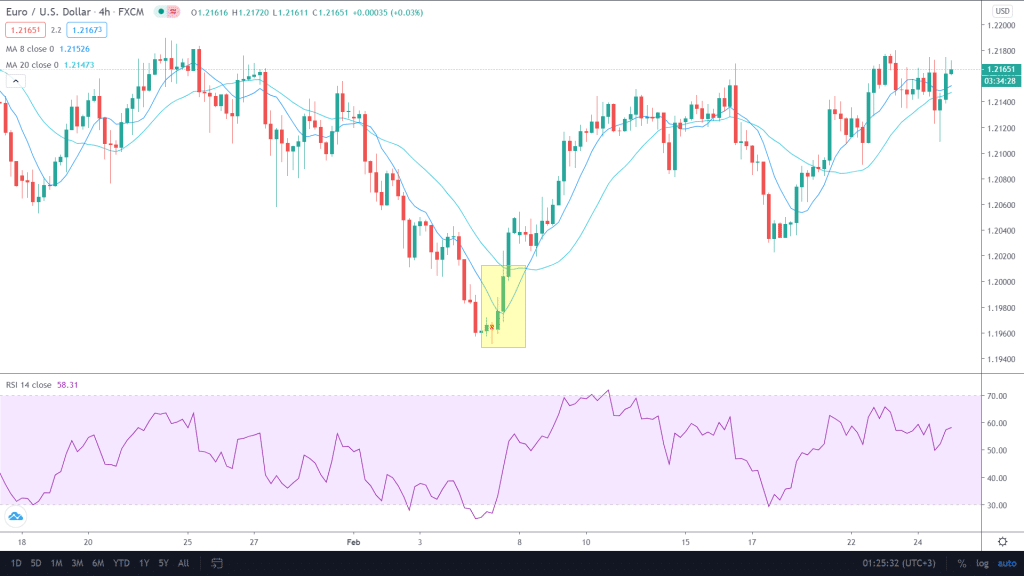

- RSI and moving averages. The RSI indicator shows divergences and overbought and oversold conditions in the market. We can use the latter to our advantage while using the cross-overs from the moving averages to identify reversals. Let us take a look at how it works in the image below.

Image 7: The RSI indicator yells oversold as it goes below the mark of 20. Additional confirmation was presented by the moving average, where a cross-over is witnessed for a potential long trade.

End of the line

Moving averages have certainly tested the mettle of time, being one of the most famous in the industry. For beginners understanding indicators such as this is considered kindergarten, which sets them up for a bright future. Learning one of the basic strategies that use the MAs as you learn various scenarios is the easiest way to win where 90% lose.