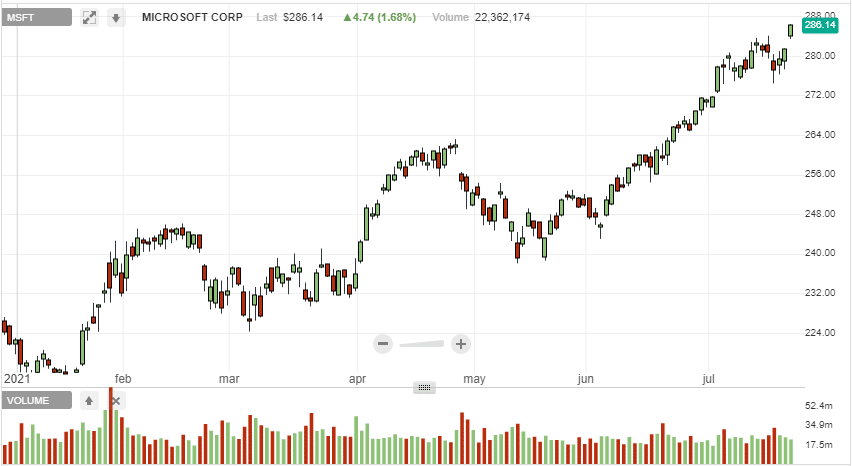

- Microsoft impressive stock performance

- Q4 Revenues and earnings to top estimates

- Impact of improved IT spending budgets

- Focus on Azure and Gaming unit

Microsoft will release its fourth-quarter results on July 27, 2021, at a time of increased corporate IT spending. The stock is up by more than 20% year to date and is trading above the $280 level. Solid Q4 results should continue to affirm the impressive run in the market that has seen the stock rally and post a new 52-week high.

Wall Street is optimistic about the software giant posting a significant increase in earnings on higher revenues. The company is believed to have benefited from recovering IT budget spending as well as reacceleration in the Azure unit.

In the previous quarter CEO, Satya Nadella sounded bullish about Microsoft’s prospects amid the accelerated global digital transformation.

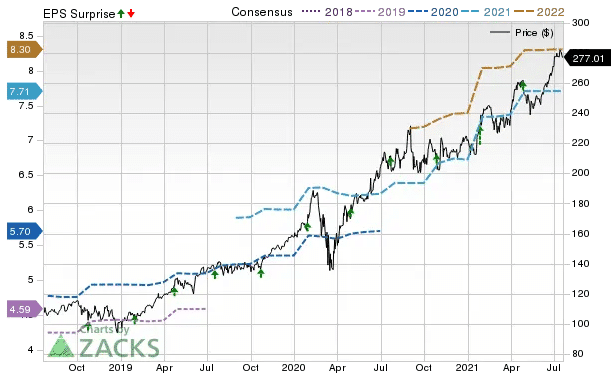

Q4 expectations

Wall Street expects the software giant to report an EPS of $1.90, representing a 30% year-over-year increase. In Q3, adjusted earnings were up 39% year over year to $1.95 per share, beating consensus estimates of $1.78 a share.

Revenues are expected to come in at $44.1 billion, up 15.9% year over year. Revenues in Q3 were up 19% year over year to $41.7 billion, topping analyst estimates of $41.03 billion, mostly driven by a 33% increase in commercial cloud revenues.

Microsoft projects revenues of between $13.8 billion and $14.05 billion for its productivity and business processess segment. On the other hand, the cloud unit Azure is expected to deliver revenues of between $16.2 billion and $16.45 billion.

What to look for

When Microsoft reports, the focus will be on the cloud and the gaming units. The company is believed to have benefited from the rise of digitization believed to have fuelled strong demand for its cloud solutions under the Azure unit.

During the quarter, the software giant also inked strategic partnerships with the likes of Fujitsu and KPMG that strengthened cloud capabilities and should help accelerate the digital transformation. In the first quarter, Azure revenues were up 46% year over year. The growth momentum is believed to have continued owing to cloud computing solutions’ strong demand.

Additionally, the tech giant has expanded its cloud offerings into new regions, including China, Indonesia, Malaysia, and the United States. The Azure communications services platform launched in Q1 is believed to have driven cloud growth in the quarter.

Microsoft workspace communication offer, commonly referred to as Teams, has enjoyed tremendous growth driven by coronavirus-induced video conferencing. The introduction of new features such as Dynamic View and Webinars has continued to strengthen its competitive edge. Consequently, the segment is expected to deliver growth in the subscriber base.

The gaming segment should also elicit interest, given the enormous efforts put into bolstering its prospects in the billion-dollar video game industry. In the recent past, Microsoft has bolstered its games lineup for the Xbox consoles with 30 new titles. The investment spree should have bolstered the company’s position in the highly competitive video game business.

The market expects Microsoft to post a substantial increase in Xbox Live monthly active users on adding more perks to the Game Pass and Game Pass ultimate subscriptions services.

Bottom line

Microsoft has been firing on all angles if the impressive stock performance is anything to go by. Investor’s sentiments in the stock have edged higher, which explains the stock’s impressive run. Conversely, a solid fourth-quarter report driven by growth in the cloud unit and the gaming unit should go a long way in strengthening investors’ sentiments which should see the stock edge higher.