GameStop is missing on the ten most purchased stocks by retail traders during the market frenzy last month, according to CNBC. The statistics, released by JP Morgan, counter the prevailing narrative that Reddit-inspired retail traders were behind the recent GameStop surge.

- JP Morgan believes institutional investors were very active in GameStop stock last week as some participate in names with elevated volume.

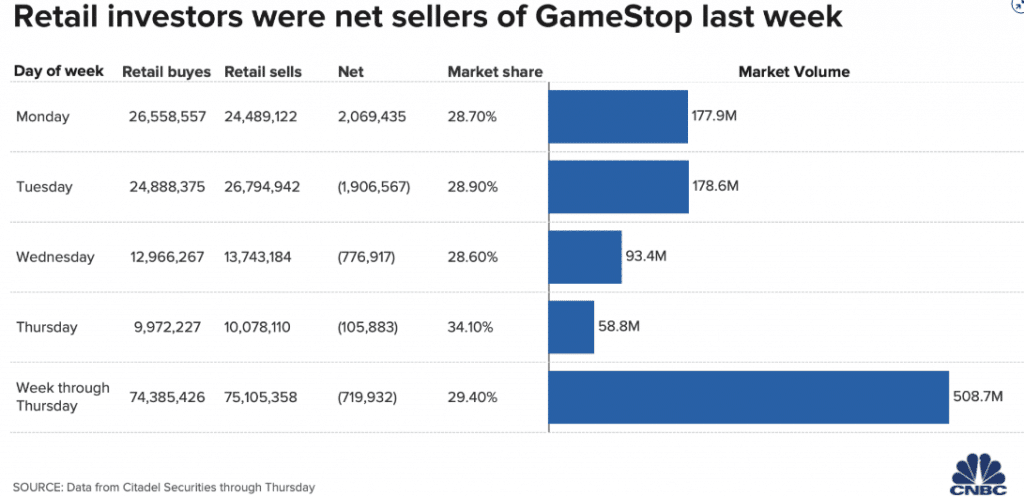

- Data from Citadel Securities also show that retail traders were net sellers of GameStop from Tuesday through Thursday.

- New York-based hedge fund Senvest Management reportedly made $700 million off the GameStop mania, further reinforcing institutional investors’ role in the trading frenzy.

- Retail trading flows dropped more than 5% amid GameStop Mania, a day after rising to a near-record high of 50% on Tuesday last week, signaling a decrease in individual investing.

- University of Chicago law professor Todd Henderson believes vindictive hedge funds were behind the buying frenzy as they tried to squeeze out hedge funds short on GameStop.

- SEC regulators are reportedly combing through Reddit posts to identify possible bad actors trying to manipulate the market last week.

GameStop is currently gaining. GME: NYSE is up 16.52%