Investments into the ETF industry is projected to increase in future as wealthy Americans seek to limit their looming capital gains taxes, according to Bloomberg. ETFs are considered to be more tax efficient, lowering capital-gain payments in new President Joe Biden’s economic plan.

EFTs use an “in-kind” process of creating and redeeming shares rather than a cash transaction, limiting the chances of a taxable transaction.

Most ETFs also rarely pass along capital gains to investors.

Wealthy investors prioritize tax considerations in relation to fund performance and fees, which could fuel moves into ETFs.

Some analysts do not expect the looming taxes to boost ETFs as wealthy investors will fear incurring huge tax liabilities in selling their mutual fund shares to switch.

Other analysts say ETFs do not suit each investors’ needs as mutual funds heavily favors U.S retirement system.

In the last 5 years, ETFs have averaged 0.92% lower tax burden compared to active mutual funds.

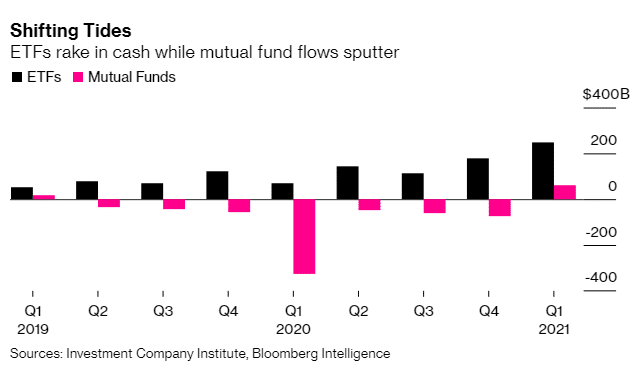

The ETF industry booked almost $500 billion in 2020, while mutual funds lost as much as $362 billion.