A hedge fund differs from traditional investments like mutual funds because fund managers have more freedom to use a wide range of strategies to reduce risks. Over the last few years, cryptocurrencies are generating extraordinary profits that are comparable to few other investments. This has given rise to crypto hedge funds, a range of professionally managed mid to long-term investments that trade in a variety of crypto assets.

Current Bitcoin price soared to $48,000, from $10,000 – $28,000 per Bitcoin in 2020, and $1 in 2011. BTC has been instrumental in elevating crypto markets to $800+ billion. How can we turn a blind eye to such extraordinary returns? Even Warren Buffet who once said Bitcoin holds “no value” must surely be a discreet part of this cryptocurrency boom. After all, he was a hedge fund manager once.

How do crypto hedge funds work?

Hedge fund managers generally employ two investment approaches: discretionary and systemic. The discretionary approach leaves investment decisions in the hands of the fund manager, and systemic involves using computer models for trades.

While systemic investments are considered less risky due to lack of human emotion; statistics reveal that the majority of crypto hedge funds adopt the discretionary approach, as these funds have outperformed systemic in the past few years.

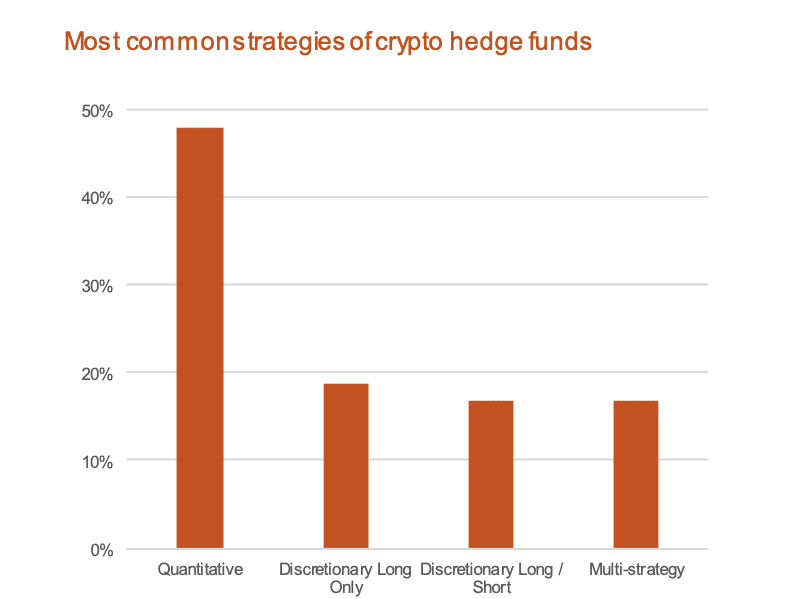

Let’s take a look at the four currently popular crypto hedge fund strategies, based on the 2020 crypto hedge fund market analysis report by PricewaterhouseCoopers (PWC).

Quantitative fund

Quantitative funds, the most popular fund strategy for 2019, use data-based mathematical and statistical methods to identify behavioral patterns and establish the probability of a certain outcome. Once a pattern is identified, the algorithm deploys the most appropriate strategy to maximize potential returns.

For example, a fund manager spots that Litecoin always follows the Bitcoin price movement, they create a program to find patterns. If a 95% accurate pattern is identified, it is assumed that there is a high probability of occurrence in the future.

They focus on high liquidity coins, with volume and price being the two common parameters.

Cambrian Asset Management, a popular fund, uses a quantitative, data-driven model, and automated trade algorithms. The Quantia Arbitrage Fund run by Quantia Capital uses an algorithmic strategy to evaluate the market depth, the spread across exchanges, and the liquidity to enter at the right time.

Discretionary long-only fund

Long-only funds take long positions only and do not engage in short-selling. These crypto hedge funds with longer lock-up periods, invest mostly in new cryptocurrencies with high liquidity and growth potential, during the ICO (Initial Coin Offering) stage. Singapore-based Astronaut Capital is one such fund that focuses on ICOs and has its own tradable token ASTRO.

I have personally enjoyed huge gains (even x30) investing in ICOs and selling them upon listing on an exchange. Of course, the ones we miss always do better. The NXT token was $0.0000168 during the ICO in 2013. Today, it trades at approx. $0.03, giving a percentage gain of 178471%. The ROI on a $1,000 investment would be $1,784,714. The all-time-high (ATH) was 0.08 during 2017.

The Digital Asset Fund by Digital Asset Capital Management has been rated as the second-highest long-only fund. Panxora Management Corporation is also known for its long-only positions in 20 cryptocurrencies. The Panxora DeFi Fund takes advantage of the current DeFi boom.

Discretionary long/short fund

This hedge fund uses a variety of strategies to increase returns. It invests in coins that are going up as well as those going down. This hedging strategy makes the most of market movements. Everything from event-driven price changes, technical analysis, and mining is an investment opportunity.

Alfred Winslow Jones, an ex-journalist, created the hedge fund in 1949 while working for Fortune. He was seeking a more flexible investing style. He started “combining” two trades by choosing two similar competing stocks that he expected would go in opposite directions. He “longed” the one he expected to go up and “shorted” the one that might go down.

The concept is simple: There will always be winners and losers. Why not make money with both?

Multi-strategy fund

As the name suggests, this fund combines various investment strategies. Diversification reduces volatility and risk of using a single strategy. Two strategies like discretionary long/short and quantitative may be combined.

Apollo Capital Fund’s multi-strategy fund received the Top Performing Multi-Strategy Crypto Fund for 2019 award by Crypto Fund Research.

What are derivatives and leverage?

Derivatives derive value from other products. They are used for speculation, hedging, or arbitrage. Fund managers can buy or sell a cryptocurrency at a particular price point in the future, without risk.

For example, your crypto hedge fund manager thinks the Bitcoin price will reach $60,000 by April. By buying BTC outright, he risks losing a lot of money if his guess is wrong. Instead, he purchases a call option for a fraction of the price. If his prediction is correct, he exercises the option and makes a profit. If he is wrong, he lets the option expire and only loses the small premium he paid for the call option.

Combined with leverage, derivatives become powerful due to huge profit margins. Most popular crypto exchanges offer margin trading with high leverage, allowing crypto hedge fund managers to invest in everything from short positions to market-neutral using borrowed funds.

What are Custody and Counterparty Risks?

Traditional investment programs offer transparency and security to investors, by using third-party custodians and ensuring counterparty risk assessments. This can be a bank’s wealth management arm or a broker that assumes custodial responsibilities.

Custody

Custody of cryptocurrencies, as opposed to fiat currencies or securities, requires a different approach as sharing private keys is risky.

A positive development in the crypto hedge fund industry is that you will find many custodians either regulated or possessing some sort of a license. They may also possess public assurance reports from CPAs, which helps with investor trust and confidence.

About 80% of the crypto fund managers are said to seek independent custodians and implement innovative ways to hold the private keys of the fund’s crypto assets, including multi-signature wallets, hot/cold wallets, etc.

Counterparty Risk

A counterparty is the second party involved in a financial transaction. In this case, it is the hedge fund you are interested in. What if the fund does not fulfill its part of the bargain? What are the steps the fund is taking to handle risks?

Most funds depend on exchanges to buy and sell cryptocurrencies, and their trading funds are open to risks like hacking. Since institutional investors look for high security, hedge funds are now focusing on the immediate and unforeseen risks, by conducting regular counterparty risk assessments.

How are they regulated?

We know how mutual funds work. They are transparent and regulated.

Hedge funds are very lightly regulated and are generally open to wealthy investors with a greater risk appetite.

Crypto hedge funds have no regulation in place as the SEC framework considers crypto assets as commodities and not securities. This means crypto fund managers have complete freedom on how and where our money is invested until the SEC designates cryptocurrencies as securities.

Crypto hedge funds like Alpha Sigma Capital, North America’s first registered crypto hedge fund, are seeking regulation to attract institutional investors. Many are already using regulated third party custodians, even if it means paying high fees.

Conclusion

Dozens (800+) of partially or exclusively focused cryptocurrency hedge funds are available today. Most of them manage top order crypto-assets like Bitcoin, Ethereum, Litecoin (LTC), XRP, Bitcoin Cash, and EOS. The majority trade derivatives or short sell.

With so many crypto funds vying with each other for investor attention, choosing the right one is not simple as we are exploring a relatively new asset class. I am digging deeper into understanding the quantitative fund that uses automated trading strategies. It is popular with fund managers and investors alike.

We must also understand that many of the top hedge funds seek high-net-worth investors, making it difficult for some of us to use their services. Hopefully, this will change in the future, as investor awareness grows and the demand increases.

Whatever fund you choose, conducting due diligence and assessing the risk involved is necessary before investing in a crypto hedge fund.

A: A crypto hedge fund is an investment fund that pools capital from accredited investors to invest in cryptocurrency assets.

A: Crypto hedge funds manage risk through diversification, strategic asset allocation, and using various trading strategies to mitigate potential losses.

A: The regulation of crypto hedge funds varies by jurisdiction, but they generally face some form of regulatory oversight to protect investors.