NIO’s stock was trading at only $7 two years ago when Citron recommended a “buy”, targeting $25, according to Citron Research. Now, Citron believes NIO’s stock is vulnerable after a rocky road to trading that has dimmed its near-term prospects based on two main reasons:

- Tesla’s Model Y China Pricing

- Citron sees Tesla cutting the price of Model Y from 488,000 RMB ($73k) to around mid-to-high-300,000 range ($56-58k).

- Tesla’s strategy of passing its cost savings to customers could make Made-in-China Model Y sell at a very reasonable price of CN¥275,000 or about $41,000

- The brand cache of Tesla and its pricing would hurt NIO’s ES6 hatchback model.

- Currently, NIO is trading at the largest premium to Tesla in history at double the valuation making its models expensive.

- Last month, TSLA doubled the number of vehicle sales that NIO sold in China.

- Share Structure

- Citron believes that the NIO’s investor base is now interested in exiting the stock, citing Baillie Gifford and other early investors.

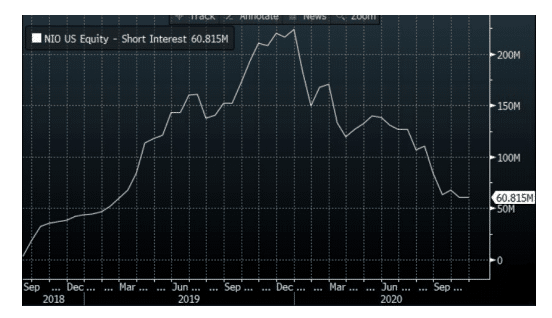

- NIO’s short term interest is almost on a 2-year low, despite the float remaining open after years of trading making it the right moment to sell the stock.

Citron is a research firm founded by Andrew Left that provides short-term-focused stock market information centered on terminal and fraudulent business models. NIO stock is currently declining. NIO: NYSE is down 2.96%