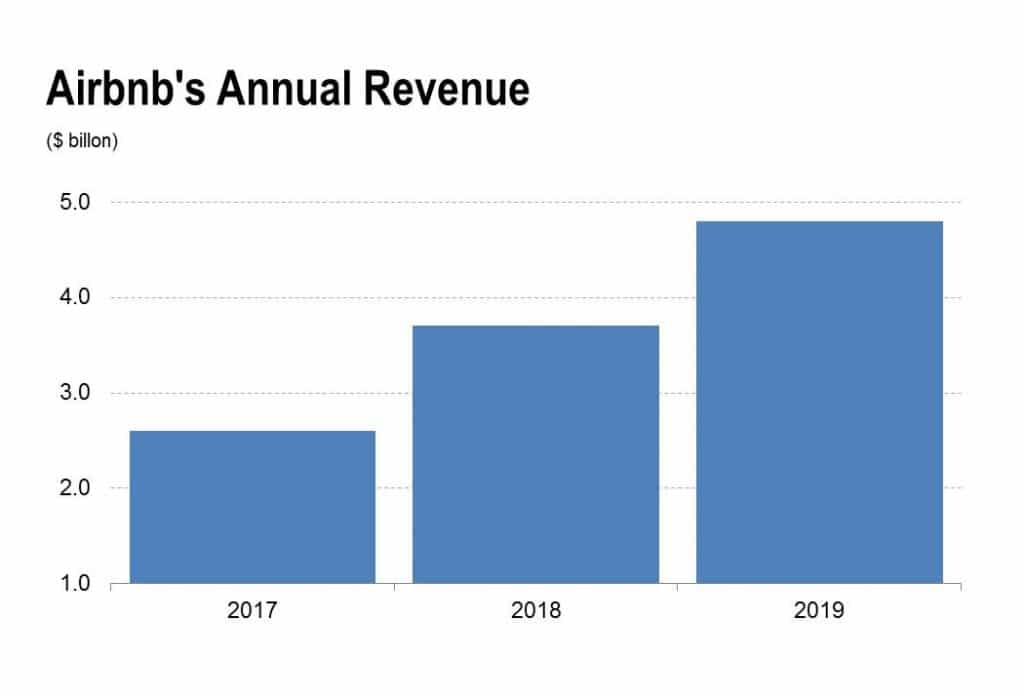

- Airbnb is taking business away from the professional hotel and lodging market. Amid the pandemic, people turn to Airbnb for short-stay accommodation to avoid hotels crowding that could expose them to the coronavirus. For a company making around $5 billion in annual revenue in a market worth $1.5 trillion currently and $3.4 trillion shortly, it is easy to see Airbnb’s compelling revenue opportunity.

- Airbnb’s management has demonstrated incredible adaptability amid the pandemic. The company’s leadership moved swiftly to cut costs in payroll and marketing. That helped secure Airbnb from the early devastating impact of the pandemic that forced many businesses into bankruptcy. Airbnb has also found more efficient methods to market its service, which should boost its profitability.

- Seeing that Airbnb priced its IPO above an already expanded range and the stock went on to more than double on debut, it goes without saying that many investors believe in Airbnb. But for a smart investment, you need to identify a good entry point into Airbnb stock.

Airbnb: the company and the business

Airbnb Inc. (NASDAQ: ABNB) is an online home rental company. It primarily serves the vacation market. It operates a marketplace where people come to list their home for rental if they have spare space, and tourists come to find vacation stays. The Airbnb marketplace is accessible through the web and mobile app. The Airbnb name is short for Air Bed and Breakfast.

Airbnb is based in San Francisco, California. It was founded in 2008 by Brian Chesky, Joe Gebbia, and Nathan Blecharczyk, who continue to serve as senior officials. Chesky is Airbnb’s CEO, Gebbia is the chief product officer, and Blecharczyk is the chief strategy officer.

Airbnb has made several acquisitions to expand, strengthen, and diversify its business. It bought its German rival Accoleo in 2011 and followed that with its London-based competitor CrashPadder in 2012. The deals significantly increased Airbnb’s international listings.

Airbnb purchased online city guide provider NabeWise and location-based question and answer platform Localmind in 2012. The company’s other notable acquisitions include Urbandoor, which provides vacation accommodation to corporate clients, HotelTonight, which helps with last-minute hotel room booking, and Luxury Retreats International, which offers high-end vacation rentals.

Airbnb makes money by receiving a commission from vacation home bookings.

Why invest in Airbnb?

The COVID-19 pandemic was both: danger and possibilities for Airbnb . People going on vacation choose to seek accommodation in spacious homes instead of hotels that can be easily crowded and expose them to the virus. However the travel volume decreased significantly in 2020.

The pandemic forced Airbnb to cut costs. The company slashed 25% of its global workforce. Additionally, the company expects its marketing expense as a percentage of revenue to decline as it adopts more efficient sales and marketing methods. These cost control measures should be good for Airbnb’s profitability moving forward.

Airbnb is a well-diversified business. The company operates in 100,000 cities, and no single city accounts for more than 2.5% of its revenue. Therefore, weakness or trouble in a couple of cities would have little impact on Airbnb’s overall financial performance. Moreover, the company generates the majority of its revenue outside the US.

Airbnb has proven it can navigate unfavorable economic climates to flourish. You have to remember that the business started during the mortgage crisis that sparked a global financial meltdown. Airbnb went on to sign up thousands of users in just a couple of months during a recession. That is a reason for hope for investors that Airbnb can weather the coronavirus storm and emerge stronger.

Airbnb has a massive revenue opportunity. The company estimates its target market at $1.5 trillion currently. But it could be worth more than $3.4 trillion in the coming years.

The pandemic has held the travel and experiences industry hostage. But the vaccines promise to bring the pandemic to an end, which should get back leisure and business travel demand, and that would, in turn, lift Airbnb’s sales.

Airbnb fundamentals

Airbnb’s revenue rose 32% to $4.8 billion in 2019. The company still made a $674 million loss, mostly due to high sales and marketing costs.

The pandemic dealt heavy blows to the travel and tourism industries, and Airbnb took its fair share of the beating. Its revenue for the first nine months of 2020 fell 32% to $2.5 billion. Consequently, the company logged a $700 million net loss in the period.

But the pandemic also brought insight into the quality of Airbnb’s leadership team. The Airbnb management demonstrated incredible adaptability by moving swiftly to mitigate the pandemic’s impact on its financials by paring down the workforce and marketing spending. The quick intervention helped Airbnb turn a profit of $219 million in Q3. That may not be great, considering the company made a profit of $267 in the same period in 2019. But that is a big deal for a company whose industry has been significantly battered by the pandemic.

Airbnb has a strong balance sheet. The company has $4.5 billion in cash against $2 billion debt as of September 2020.

A look at Airbnb’s technicals

Airbnb’s fundamentals are exciting. But is it the right time to enter the stock? For investors looking for a good entry point into a stock, technical analysis helps with that. But Airbnb has not established a robust technical profile, having just gone public toward mid-December. Still, the Airbnb stock chart tells an interesting story.

Airbnb priced its IPO at $68 a share. That was above the expected range of $56 – $60. It originally priced the IPO in the range of $44 – $50.

It was a little surprising that Airbnb decided to go public in the middle of a pandemic. But investors were ready for it. Airbnb stock soared in its market debut even after pricing its IPO above an already boosted range. About five days into the debut, some investors started taking profits. But others saw the pullback as a buying opportunity and moved swiftly to capitalize on it. The stock currently sports an all-time high of $175.

Looking at the available technical indicators, Airbnb stock looks richly priced right now. It may be best to wait for an excellent opening to arise.

Conclusion

Airbnb stock has many potential tailwinds that could take it above $200. But for a good deal, we recommend BUY on a pullback.