S&P Global Inc. and some investors are distancing themselves from the marine ports operator controlled by Indian’s Adani Group, according to The Wall Street Journal. The move follows past business transactions with a company linked to the military regime in Myanmar.

S&P Global Inc., a financial data, last week said it would remove Adani Ports & Special Economic Zone Ltd. from its Dow Jones Sustainability Indices.

Adani Group assured that it is committed to ensuring its activities in Myanmar don’t provide economic support to sustain the military regime.

The removal of Adani Ports from the S&P sustainability indexes sends a cautionary tone for other socially conscious entities doing businesses in countries having political turmoil

S&P’s decision means that any index funds tracking those benchmarks will cut out Adani Ports

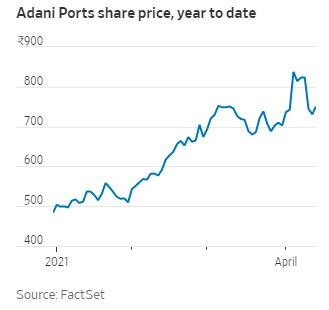

Some investors pulled back from Adani Ports in recent weeks citing human rights concerns

The move against Adani Ports comes weeks after the U.S placed sanctions against Myanmar Economic Corp.

Adani Group stock is currently declining. ADANIENT: NSE is down 2.10%